Llc Tax Filing Deadline 2021 California

15th day of the 3rd month after the close of your tax year. People and corporations affected by the California wildfires who had a valid extension to file their 2019 tax returns by October 15 2020 now have until January 15 2021 to file their returns.

Aicpa Urges Irs To Extend 2021 Tax Deadline Cpa Practice Advisor

Most states do not restrict ownership so members may include individuals corporations other LLCs and foreign entities.

Llc tax filing deadline 2021 california. Depending on elections made by the LLC and the number of members the IRS will treat an LLC either as a corporation partnership or as part of the owners tax return a disregarded entity. As an example if your California LLC was approved in November on any day of 2020 November is counted as month 1. Extended filing due date.

Beginning 2021 California LLCs dont have to pay 800 franchise tax for the 1st year. Use LLC Tax Voucher 3522 when making your payment and to figure out your due date. Please contact the local office nearest you.

Intuit reserves the right to modify or terminate this TurboTax Live Basic Offer at any time for. Owners of an LLC are called members. This extension does not affect estimated quarterly taxes which are still due April 15 2021 for non-employee income.

Public Affairs Office. 15th day of the 4th month after the beginning of your tax year. A Limited Liability Company LLC is an entity created by state statute.

Your annual tax amount is 800. So the 4th month after that is February of 2021 not March which is what most people think. Sales and Use Tax.

Different types of business entities file tax returns in different ways. Last updated December 26 2020. You form a new LLC and register with SOS on June 18 2020.

Partnerships and S Corporations must apply by March 15 2021 which extends their tax-filing deadline to September 15 2021. Online videos and Live Webinars are available in lieu of in-person classes. If your California LLC goes into existence on or after January 1st 2021 but before December 31st 2023 there is no 800 payment due the 1st year.

15th day of the 10th month after the close of your tax year. When the due date falls on a weekend or holiday the deadline to file and pay. Each state may use different regulations you should check with your state if you are interested in starting a Limited Liability Company.

Sacramento The Franchise Tax Board FTB today announced that consistent with the Internal Revenue Service it has postponed the state tax filing and payment deadline for individual taxpayers to May 17 2021. January 1 2021 is the first day of its first tax year. Sole proprietorships and single-owner LLCs must apply for an extension by May 17 2021 which extends their tax-filing deadline to October 15 2021.

For those affected by Hurricane Delta with valid extensions to file by October 15 may file their returns by February 16 2021. November 2020 prepayment due. Meets the requirements of Californias 15-day rule and will not need to file a California tax return for 2020.

Must file by May 3 2021 to be eligible for the offer. Lets look at a few examples below. A Limited Liability Company LLC is a business structure allowed by state statute.

You have until the 15th day of the 4th month from the date you file with the SOS to pay your first-year annual tax. And the 15th day would make your first 800 payment due by February 15th 2021. A domestic LLC with at least two members is classified as a partnership for federal income tax purposes unless it files Form 8832.

You must apply for a tax extension no later than your typical tax deadline. For questions about filing extensions tax relief and more call. The IRS announced an extension to May 17 2021 of the deadline for filing individual income tax returns including those who pay self-employment taxes.

Assembly Bill 85 provides a first-year exemption from the 80000 annual tax to limited partnerships limited liability partnerships and limited liability companies that organize or register with the California Secretary of State on or after January 1 2021 and before January 1 2024. The annual LLC tax is due and payable by the 15th day of the 4th month after the beginning of the LLCs taxable year fiscal year or April 15 2021 calendar year. The first 800 payment is due in the LLCs 2nd year.

CDTFA public counters are now open for scheduling of in-person video or phone appointments. Annual Franchise Tax 800 LLC University. California LLC franchise tax due dates after Assembly Bill 85.

Businesses impacted by the pandemic please visit our COVID-19 page Versión en. Your annual LLC tax will be due on September 15 2020 15th day of the 4th month. Includes states and one 1 federal tax filing.

State Conformity To Irs Income Tax Deadline Extension Wipfli

Https Www2 Deloitte Com Content Dam Deloitte Us Documents Tax Us Tax Multistate Covid 19 State And Local Tax Due Date Relief Developments Updated 52120 Pdf

Individual Tax Filing Deadline Extended To May 17th 2021 Tax Plus

Https Www2 Deloitte Com Content Dam Deloitte Us Documents Tax Us Tax Multistate Covid 19 State And Local Tax Due Date Relief Developments Updated 52120 Pdf

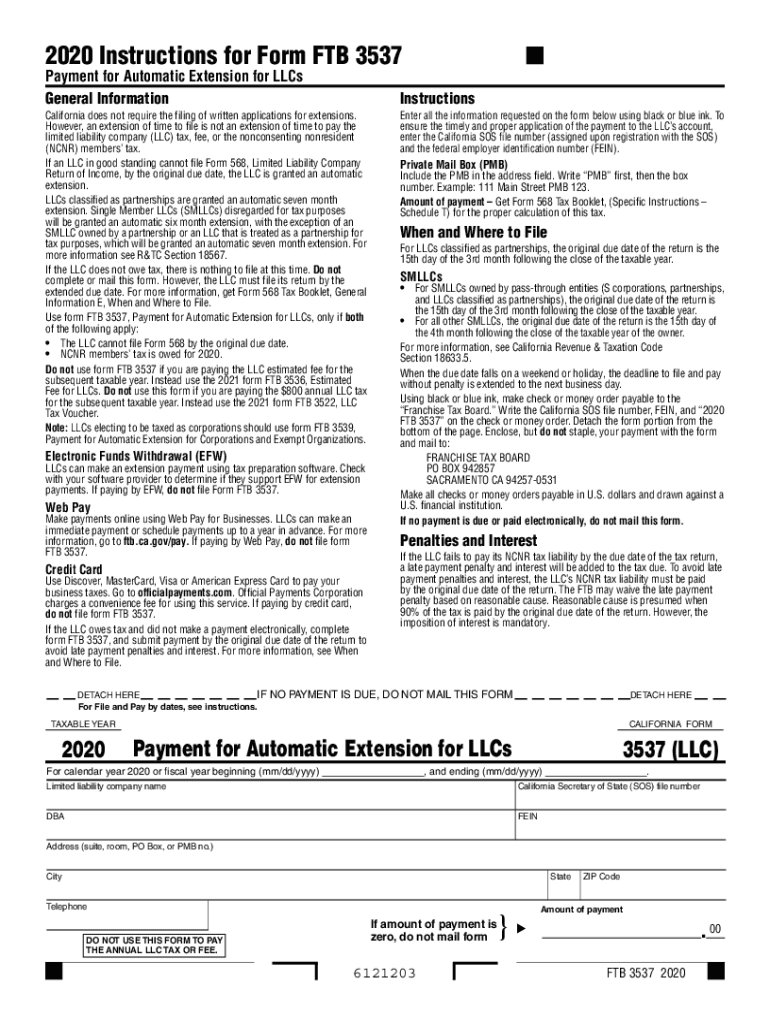

Ca Ftb 3537 2020 2021 Fill Out Tax Template Online Us Legal Forms

Individual Tax Filing Deadline Extended To May 17th 2021 Tax Plus

When Are The 2021 State Filing Deadlines Taxslayer Pro S Blog For Professional Tax Preparers

Https Www2 Deloitte Com Content Dam Deloitte Us Documents Tax Us Tax Multistate Covid 19 State And Local Tax Due Date Relief Developments Updated 52120 Pdf

Https Www2 Deloitte Com Content Dam Deloitte Us Documents Tax Us Tax Multistate Covid 19 State And Local Tax Due Date Relief Developments Updated 52120 Pdf

Tax Day April 15 Key Date For Some Despite Extension

What To Do If You Miss The Tax Filing Deadline The Official Blog Of Taxslayer

What If You Can T File Your Income Taxes By April 15 The Irs Gives Extensions To Anyone Cpa Practice Advisor

California Llc Franchise Tax Waived In First Year

Https Www2 Deloitte Com Content Dam Deloitte Us Documents Tax Us Tax Multistate Covid 19 State And Local Tax Due Date Relief Developments Updated 52120 Pdf

Https Www2 Deloitte Com Content Dam Deloitte Us Documents Tax Us Tax Multistate Covid 19 State And Local Tax Due Date Relief Developments Updated 52120 Pdf

How To Deduct Stock Losses From Your Taxes Bankrate

How To File Robinhood 1099 Taxes

California Llcs Won T Have To Pay Annual 800 Tax Their First Year Starting Next Year Limited Liability Company Budgeting New Law

When Should You Amend Your Tax Return The Turbotax Blog

Post a Comment for "Llc Tax Filing Deadline 2021 California"