Average First Year Business Loss

If your business runs at a loss. The basic idea is that if you conduct more than 50 of your business from home you are allowed to claim many different business costs such as rent mortgage.

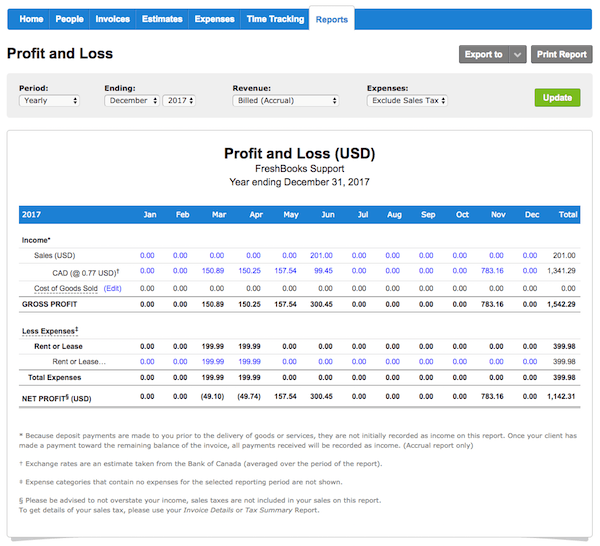

Profit And Loss Statement For Small Business Template Free Pdf Google Docs Google Sheets Excel Word Apple Numbers Apple Pages Pdf Template Net Profit And Loss Statement Statement Template Cash

Here are five things you can anticipate in your first year and how you can deal.

Average first year business loss. I understand wanting to do your own taxes. So for our first year in business we are claiming a business loss. Now that weve got that out of the way lets review what the average profit margin is of the average business in North America.

Net Profit 170000. The first year of restaurant ownership can leave you feeling nothing short of overwhelmed. Financing for this growth will come from the free cash flows generated by the healthy margins in this business once break-even volume has been achieved in the first year.

COGS Cost of Goods Sold 500000. If your costs exceed your income you have a deductible business loss. Namely it means you personally own a business and its assets.

INCOME for First Year. Nothing can quite prepare you for the rigors of entrepreneurship but done right that first year in business can be. In your first year your operational costs will be higher than in any other year.

Surviving Your First Year. I extracted the data into the following chart. Even with a low start-up cost business you will eventually need to invest money into your business in order to grow it by expanding products services moving into new geographic territories or.

This amount is greater than the 250000 limit so he can only take 250000 of loss on this years return leaving 75000 of loss that he might be able to carry forward to the next tax year or beyond. Growth of about 300000 is expected in sales from the first year to second and over 400000 from the second year to third. Few small businesses make much profit their first year - if they make any profit at all.

You deduct such a loss on Form 1040 against any other income you have such as salary or investment income. Selling mens trouser at the rate of 28. Gross Profit 500000.

Below are the sales projections that we were able to come up with for the first three years of operations. The average small business revenue with no employees is 44000 per year and the average revenue of a small business with employees is 49 million in 2021. If your business loss is greater than your other income you make a tax loss.

Now lets say Tom a single taxpayer has a business loss for the year of 325000. However the first year of business is a bad time to start doing it youself. First Year Business Shows Loss.

But a business loss isnt all badyou can use the net operating loss to claim tax refunds for past or future tax years. Even companies that turn a profit may lose it in their first year when they invest back in their business by hiring new people or expanding their product or service offerings. A business loss occurs when your business has more expenses than earnings during an accounting period.

The main aspect of these deductions that I was not aware of was all of the home expenses that we are able to deduct. The worst mistake a new restaurant can make is. I highly recommend going to a tax professional for at least the first year of business and once you get an idea for how things work for the business THEN you may want to try them on your own.

You determine a business loss for the year by listing your business income and expenses on IRS Schedule C. Revenue 1000000. You meet any of the general exemptions that apply under the non-commercial business loss measures.

And then theres the reality that 25 percent of new businesses fail in their first year according to the Small Business Administration. The loss means that you spent more than the amount of revenue you made. If your business runs at a loss you may be able to claim your primary production losses immediately against other income if either.

So Im here to help. Average Revenue by Employee Size Small to Medium Size Business. The above average small business revenue addresses the revenue question.

1000 pairs of jean sold will cost 22000. Selling womens jean at the rate of 22.

A Beginner S Guide To A Profit And Loss Report

Average Income Tax Preparation Fees Increased In 2015 Tax Prep Tax Preparation Income Tax Preparation

Restaurant Profit Loss Workbook Coffee Shop Business Restaurant Plan Restaurant Business Plan

How To Prevent Summer Learning Loss Summer Learning Loss Learning Loss Summer Learning

Using Microloans To Finally Operate At A Profit Business Advice Business Look Business

Top 5 Tax Loss Harvesting Tips Physician On Fire Step Guide Business Credit Cards Mutuals Funds

Download Best Of Letterhead Sample Excel Lettersample With Regard To Site Visit Report Template Business Plan Template Spreadsheet Template Statement Template

3 Simple Calculations For Revealing The Health Of Your Business Bookkeeping Business Accounting And Finance Business Analysis

My Accounting Plus Profit And Loss Statement Financial Documents Accounting

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

20 Overlooked Unusual Tax Deductions You May Be Eligible For Tax Deductions Business Tax Deductions Small Business Tax Deductions

3 Warning Signs In Your Profit Loss Income Statement Bean Ninjas

Stocks End Flat Securities And Exchange Commission Business Pages Floor Price

Profit And Loss Statement For Service Business Template Profit And Loss Statement Learn Accounting Income Statement

Step By Step Instructions To Fill Out Schedule C For 2020

Real Estate Profit And Loss Statement Form How To Create A Real Estate Profit And Loss Statement Form Download Th Profit And Loss Statement Profit Templates

Profit And Loss Statement For Self Employed Template Business Balance Sheet Template Balance Sheet Statement Template

2018 Last Minute Year End Tax Deductions For Existing Vehicles Tax Deductions Business Tax Deductions Deduction

Post a Comment for "Average First Year Business Loss"