What Is The Due Date For Llc Tax Returns

15th day of the 3rd month. Corporate tax returns are due and taxes are payable on the 15th day of the fourth month after the end of the companys fiscal or financial year.

How To File An Extension For Taxes Form 4868 H R Block

The July 15 due date generally applies to any tax return or tax payment deadline that was postponed due to COVID-19.

What is the due date for llc tax returns. Fiscal year-end other than 31st December the due date is 15th day of 4th month after the tax year-end. This is the deadline to file Individual tax returns Form 1040. Except for 1099-MISC electronic filing of Forms 1099 and 1098 is due March 31.

Tax extension requests are due by this date. Original return or 6-month extension due date. If your income is below 66000 for the tax year you can e-file for free using IRS Free File.

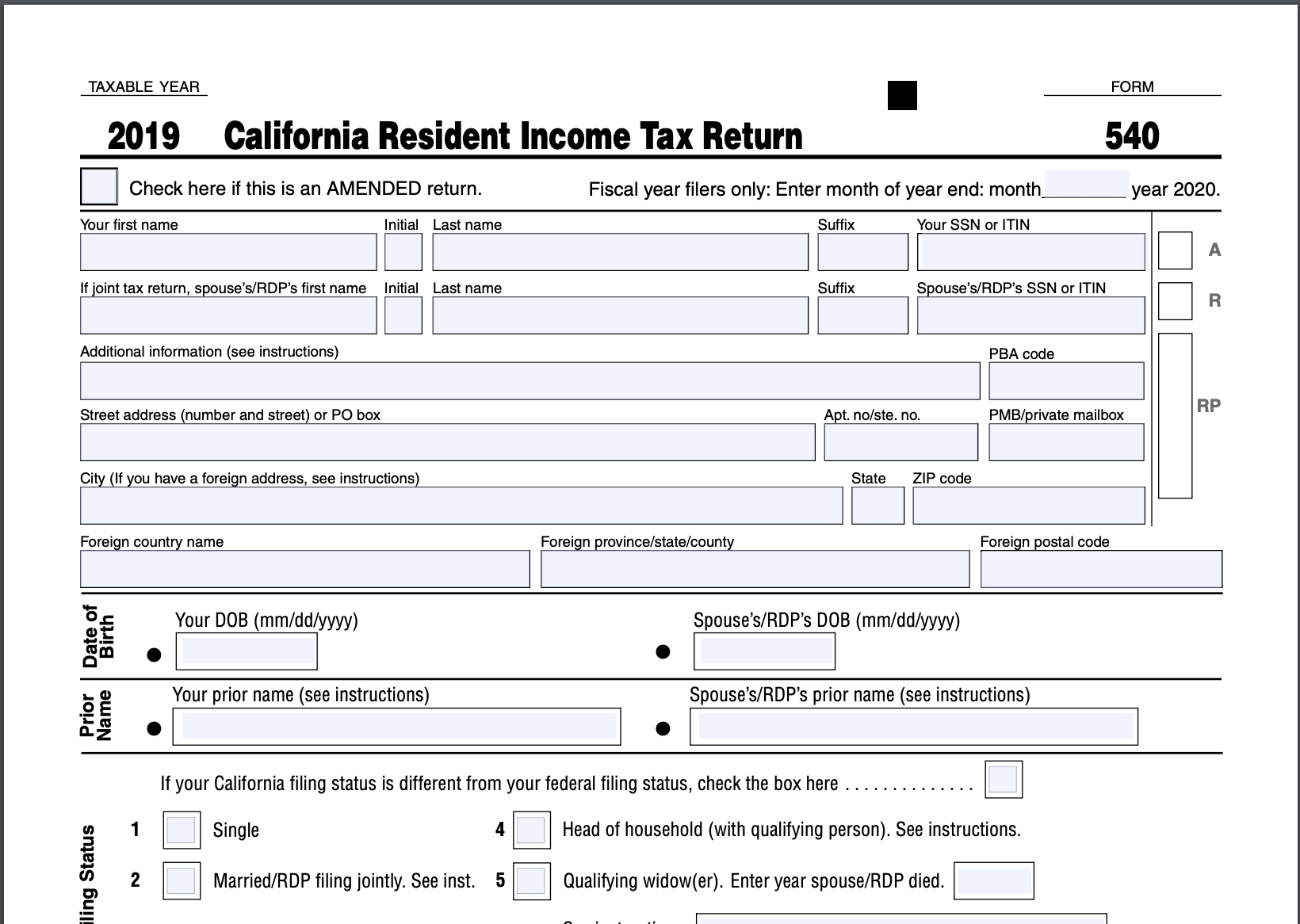

Its tax return for the current year is due on April 15 of the following year. People and corporations affected by the California wildfires who had a valid extension to file their 2019 tax returns by October 15 2020 now have until January 15 2021 to file their returns. The due dates for 2020 are on April 15th June 15th September 15th and January 15th 2020 on a calendar tax year.

4 rows Visit the LLC Fee chart 18 to figure your fee amount. The penalty for failure to file by the due date is a percentage of the tax due with a minimum penalty of 10. LLC members who must make estimated tax payments on their share of income should pay them four times a year.

Single member LLCs in Kentucky are required to file Form 725 Kentucky Single Member LLC Individually Owned Income and LLET Return. In April the IRS said that this postponement applied to all taxpayers that had a filing or payment deadline falling on or after April 1 2020 and before July 15 2020. Your annual LLC tax will be due on September 15 2020 15th day of the 4th month Your subsequent annual tax payments will continue to be due on the 15th day of the 4th month of your taxable year.

For 2021 the individual tax return date has been moved from April 15 to May 17. When the fiscal year-end of the corporation is 31st December the new due date for the tax returns 2020. Extended due date of Form 1065.

An extension of time to file the return for 6 months is available which will make the due date of the return September 15. The annual tax payment is due with LLC Tax Voucher FTB 3522. You do not need to file any separate paperwork for the LLC itself.

Generally an election specifying an LLCs classification cannot take effect more than 75 days prior to the date the election is filed nor can it take effect later than 12 months after the date the election is filed. For those affected by Hurricane Delta with valid extensions to file by October 15 may file their returns by February 16 2021. Corporation tax returns are generally due on the 15th day of the fourth month after the end of the companys financial year.

April 18 is the general deadline for individual tax returns for Forms 1040 1040EZ and 1040A. Normally it is April 15 but the IRS extends it to the 18th. An LLC may be eligible for late election relief in certain circumstances.

The answer to the question When are LLC taxes due comes down to whether LLC members owe estimated taxes and how the IRS treats your LLC. Individual Income Tax Return Form 1040 along with payments you owe. The due date for a multi-member LLC which is filed as a partnership unless an election was made to be taxed as a corporation is March 15.

Therefore it is required to follow the filing and payment requirements that apply to partnerships. For example a corporation with a year-end date of December 31 must file and pay taxes by April 15. As such a 2017 Schedule C form along with the personal tax return of the owner is due on April 17 2018.

For example a corporation with a year-end date of December 31 must file and pay taxes by April 15. Business Tax Return Due Dates of 2021. A multi-member LLC is typically taxed as a partnership.

However if your businesss fiscal year ends on June 30 you must file Form 1120 by the 15th day of the third month. All of the income and expenses from your LLC are reported on your personal tax return which is due on April 15.

What Is Form 1120s And How Do I File It Ask Gusto

Federal And State Tax Payment Deadlines Extended To July 15 The Santa Barbara Independent

When Are 2018 Tax Returns Due Every Date You Need To File Business Taxes In 2019

When Are 2019 Tax Returns Due Every Date You Need To File Business Taxes In 2020

Make Sure You Know Your Irs Tax Deadlines For Filing Your 2020 Business Taxes In 2021

Form 1065 Instructions Information For Partnership Tax Returns

When Are Taxes Due For An Llc Legalzoom Com

Irs Extends Tax Deadlines For Texas Residents And Businesses Mc Gazette

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

When Is A Corporate Tax Return Due

Understanding The 1065 Form Scalefactor

Irs Makes It Official Tax Deadline Delayed To May 17 2021 Cpa Practice Advisor

Irs And Many States Announce Tax Filing Extension For 2020 Returns

What Is Form 1065 Partnership Tax Return Guide

Will Ohio S Tax Filing Deadline Be Postponed To May 17 To Match The New Irs Deadline Cleveland Com

Us Tax Deadlines Updated For Expats Businesses Online Taxman

When Are 2019 Tax Returns Due Every Date You Need To File Business Taxes In 2020

October 15 Is The Deadline For Filing Your 2019 Tax Return On Extension

Post a Comment for "What Is The Due Date For Llc Tax Returns"