Is The Covid Small Business Grant Taxable

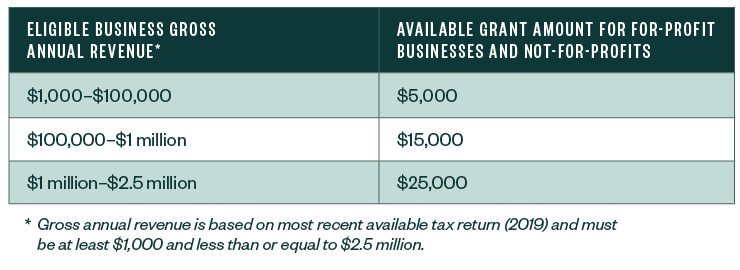

7 hours agoThe Pandemic Small Business Recovery Grant fund set up by Empire State Development totals 800 million and is available for companies whose revenue last. Grants are available to California-based businesses operating since at least June 1 2019 that have been affected by COVID-19Small businesses with 1000 to 100000 in annual gross revenue are eligible for a 5000 grant.

State Covid 19 Grants Are Taxable Income Pg Co

Any links to that information.

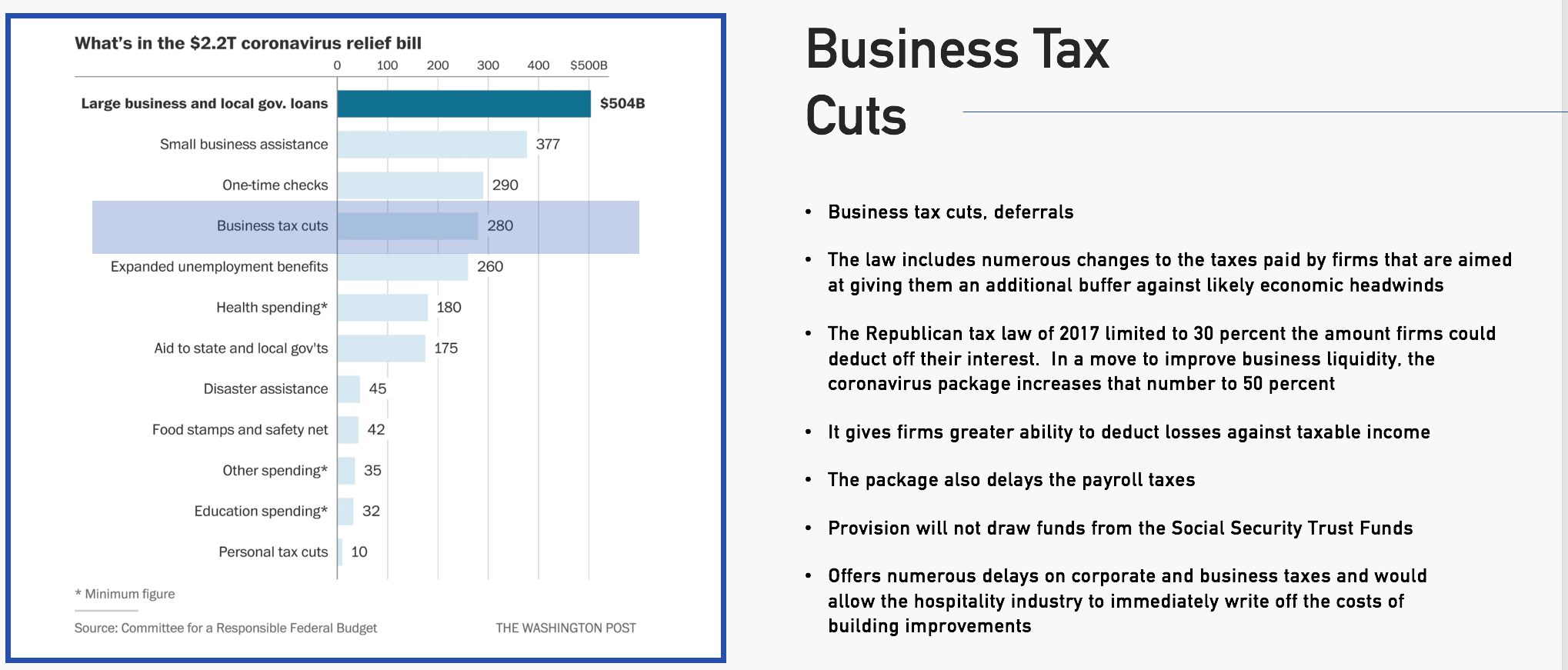

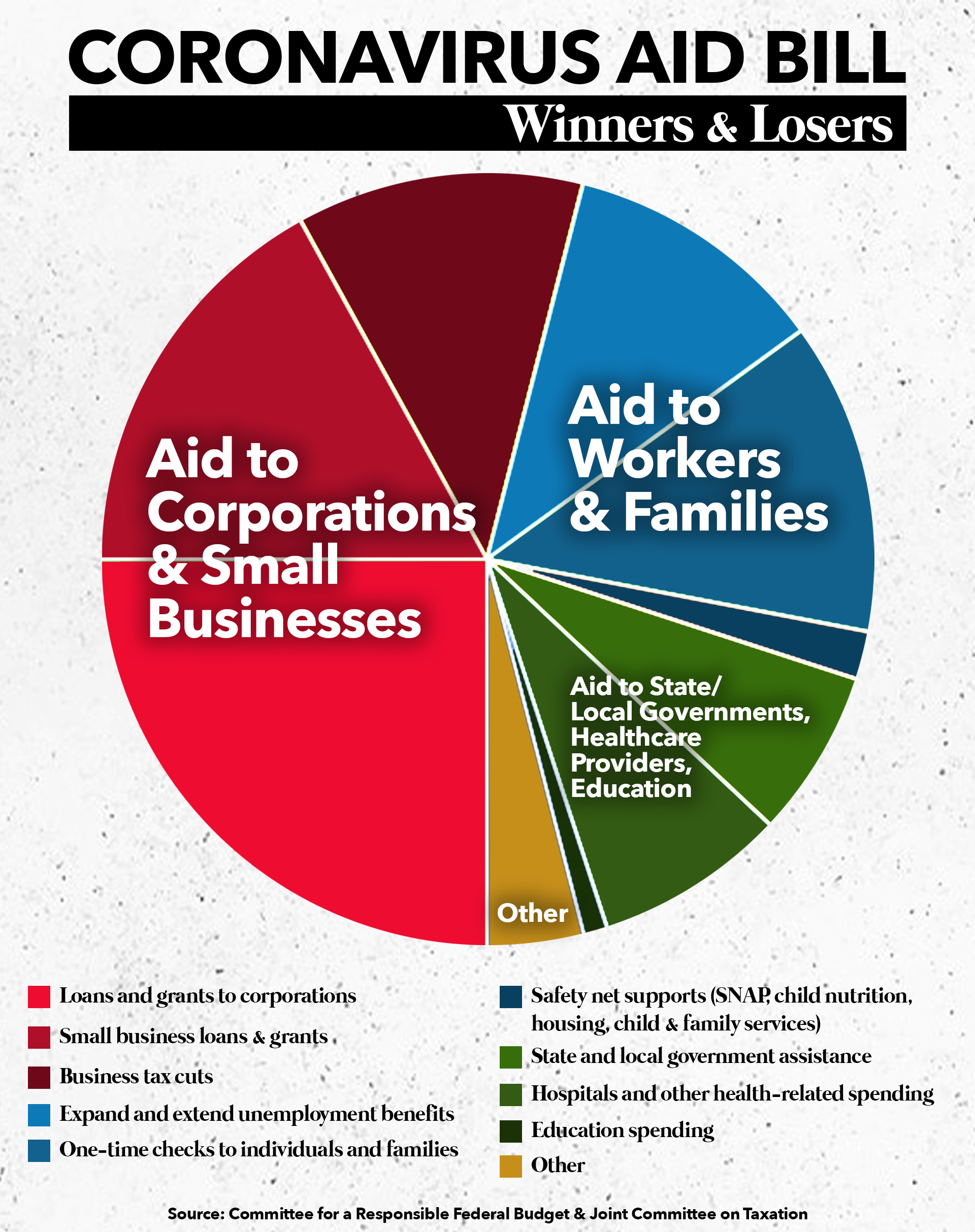

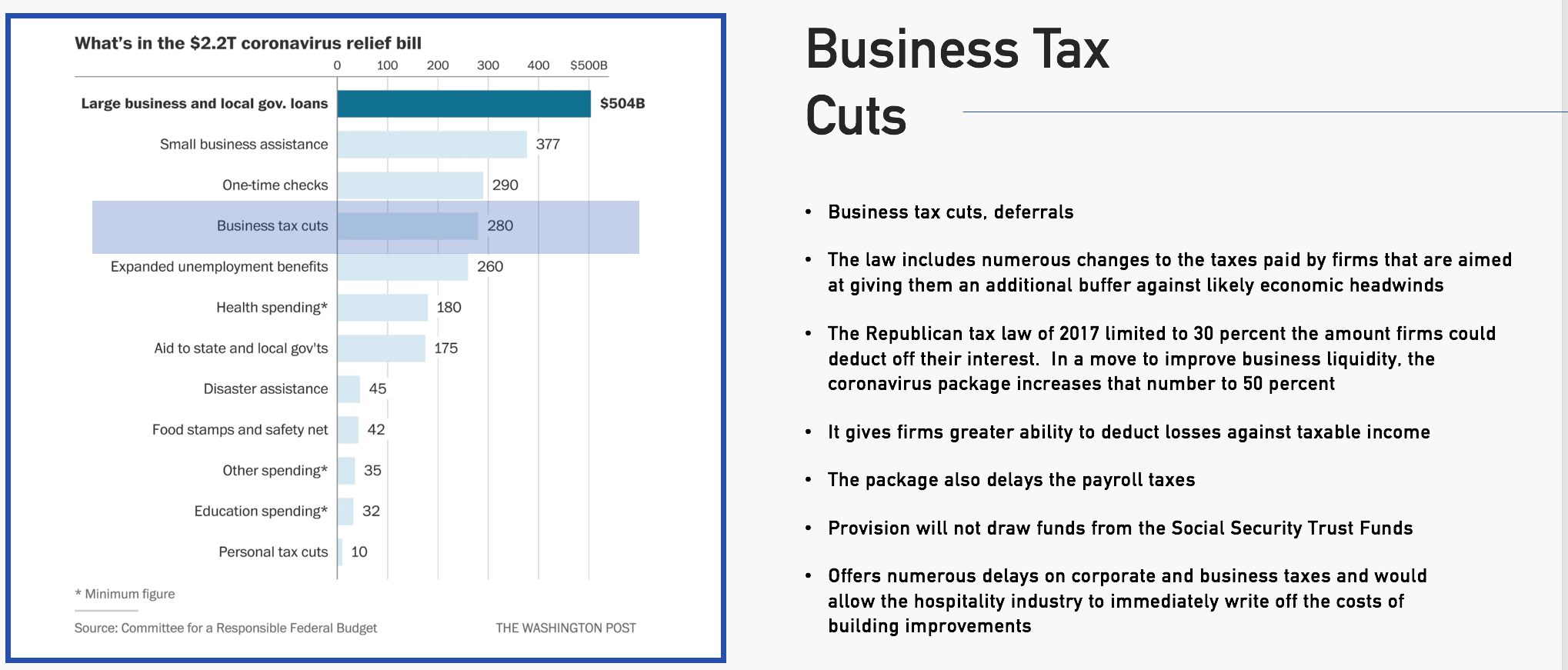

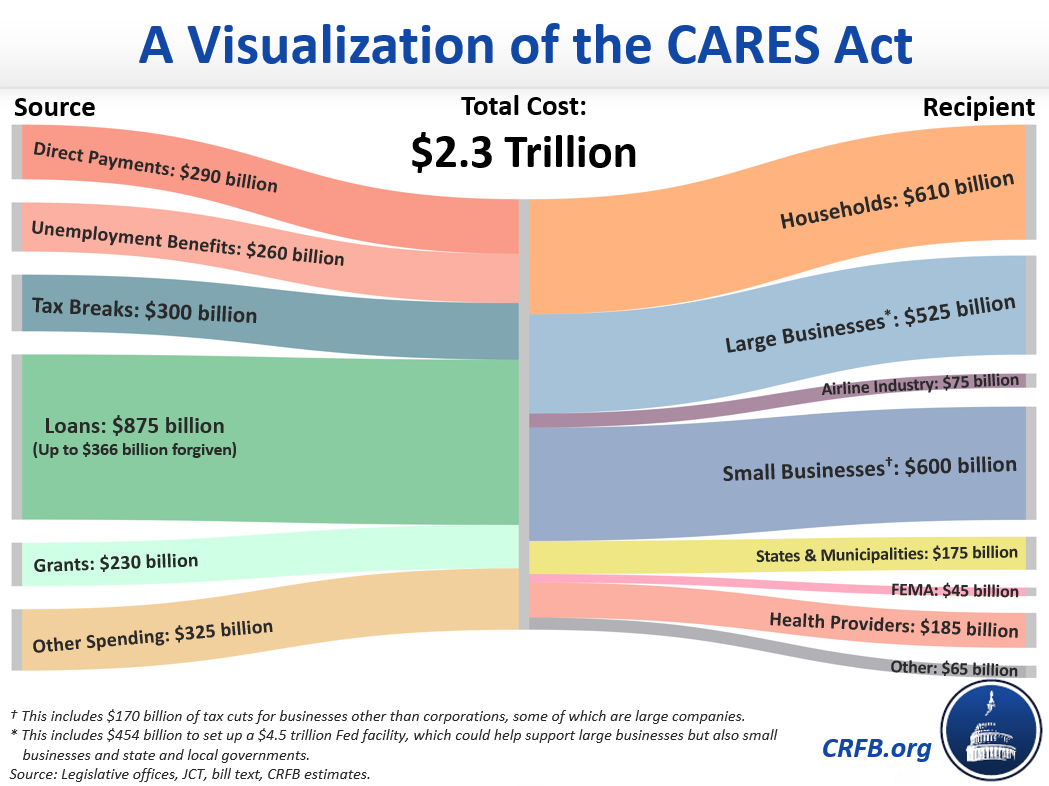

Is the covid small business grant taxable. Whether you record them as sales or other income in your accounts the grants are taxable income the tax treatment of such payments is well established so the Government isnt being unfair in any way by classing such payments as taxable. Small Business Grant Program Small Businesses Nonprofits Startups. Under the Coronavirus Aid Relief and Economic Security Act CARES Act as originally enacted March 27 2020 the Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50 of the qualified wages an eligible employer pays to employees.

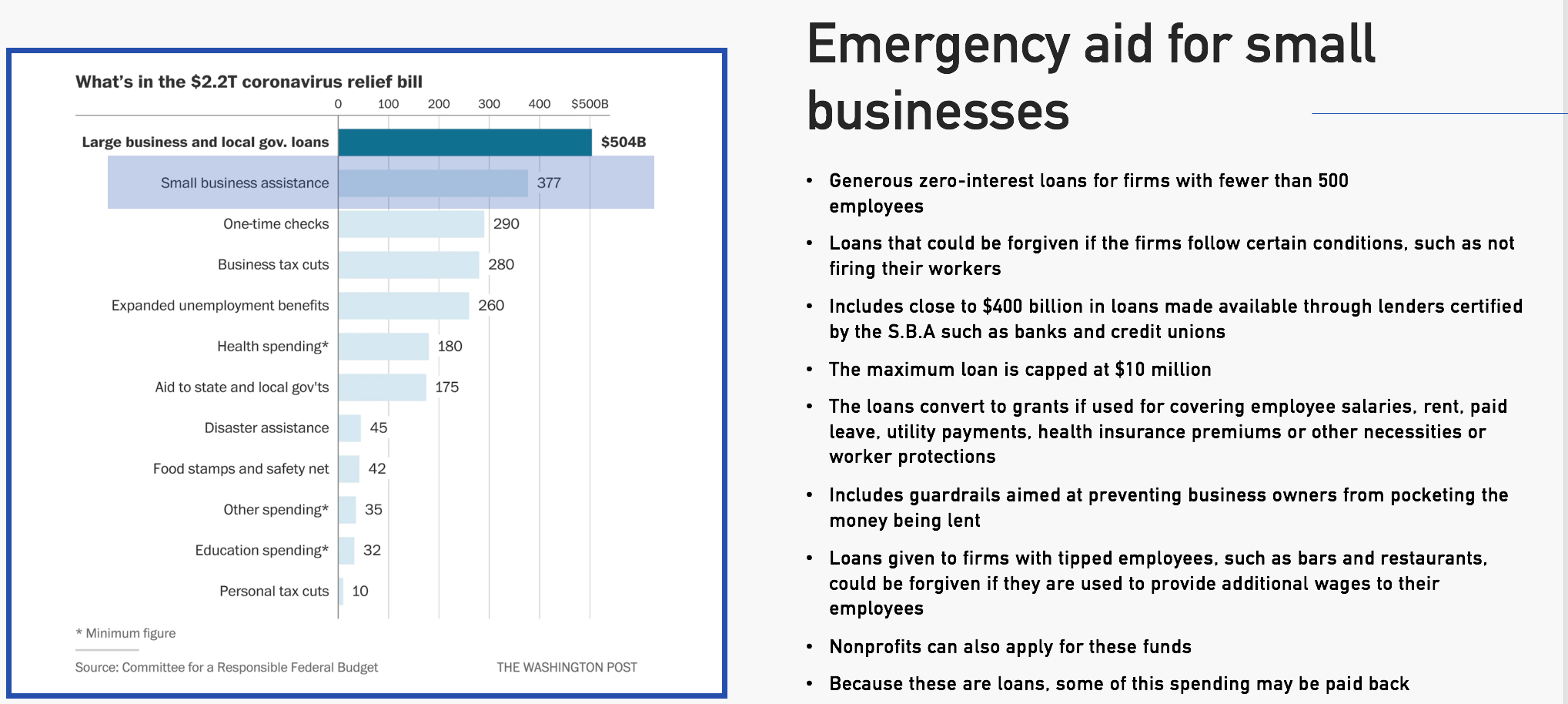

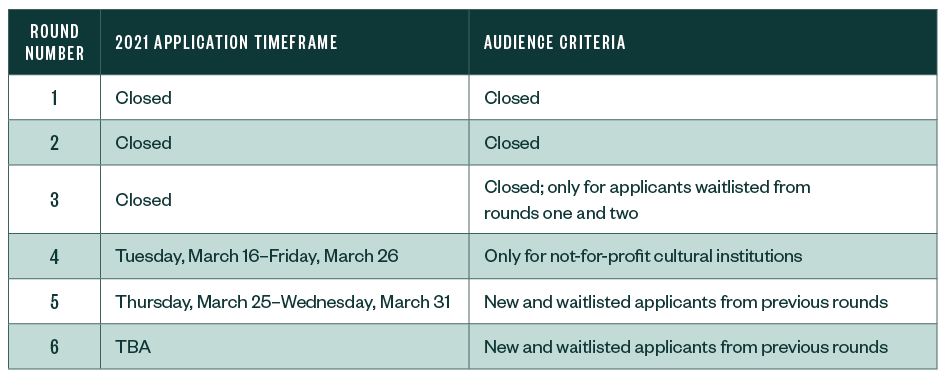

Originally it required employers to keep paying employees who had to miss work due to COVID-19 and those who did received a tax credit to help cover the costs. 11 hours agoGovernor Andrew M. Provides competitive micro grants ranging from 5000 to 25000 to eligible small businesses and nonprofits affected by COVID-19 and the related health and safety restrictions.

So we know that the direct grants of up to 2500 per month for three months to the self employed are taxable - but has anybody found any utterances regarding the COVID-19 Small Business Grant Scheme assistance by grant to Business Rates payers taxable. At the TIN level you would apply to either. Are these grants taxable.

For each unique Tax ID Number you may submit an application. Abi operates a hairdressing salon. As Abi received the payroll tax relief she has a smaller allowable deduction in her 2020 tax return.

SBA is accepting applications for EIDLs until December 31 2021. SBGF and RHLGF grants are classed as business income and should be recorded in your accounts as such. 1 day agoThe State Legislature is expected to approve a proposal from Gov.

Government and local authorities have announced and distributed grants to help smaller businesses adversely affected by the coronavirus crisis. The state government introduces payroll tax relief for all small businesses to help them cope with the impacts of COVID-19. 2 days agoWe want to make sure all 800 million of the COVID-19 Pandemic Small Business Recovery Grant Program is available to help grantees and this legislation will eliminate state taxes on.

Apply online for a COVID-19 Economic Injury Disaster Loan. Applications for the program will be accepted beginning Thursday. What Is a Grant.

And are the different schemes for. COVID-19-related grants to businesses do not qualify as tax-free under the general welfare exclusion and are generally taxable including state and local grants. 1 day agoIt authorizes businesses to deduct from the excise tax any CARES Act funds that were given to the business in response to the COVID-19 pandemic.

1 day agoWENY - Governor Andrew Cuomo proposed a new law that waives taxes on funding from the COVID-19 Pandemic Small Business Recovery Grant. An Economic Injury Disaster Loan EIDL helps small businesses and nonprofits that are losing money during the coronavirus pandemic and that need funds for financial obligations and operating expenses. This bill for taxable years beginning on or after January 1 2021 and before January 1 2026 would exclude under both laws from gross income the amount of a grant awarded pursuant to the California Small Business COVID-19 Relief Grant Program.

In an effort to stave off economic devastation caused by the COVID-19 pandemic billions of dollars in grants are being handed out to individuals and businesses by the federal government and by state and local governments as well. Cuomo today announced that applications are now open for the 800 million COVID-19 Pandemic Small Business Recovery Grant ProgramThe program reimburses New York small businesses with grants of up to 50000 for COVID-related expenses incurred between March 1 2020 and April 1 2021. The relief is delivered as no payroll tax payable for the quarter April to June 2020.

800 million was put into the program. COVID 19 and Small Business Grant Fund Posted about a year ago by James in Lincolnshire In response to COVID 19 local authorities are providing 10000 from the Small Business Grant Fund SBGF. Like most things in the world of taxes it depends.

2020 as well as records of other Federal COVID grant funding received. Cuomo to exempt the COVID-19 Pandemic Small Business Recovery Grant Program from state income tax. Is COVID-19 Small Business Grant Scheme taxable.

This is all in an effort to help small businesses recover. The Family First Coronavirus Response Act FFCRA was designed to help American families and small businesses. Coronavirus grant income is taxable and for some this tax will be due sooner than they think.

Coronavirus Response Page At Laedc 2021 Los Angeles County Economic Development Corporation

Department Of Commerce Details Covid 19 Impacts On Industry Sectors And Its Economic Recovery Plan For Small Businesses Washington State Wire

Covid 19 Related Government Grants Taxable Or Not

Covid 19 Assistance Extended For California Small Business Not For Profits

Resources For Small Businesses In Response To The Covid 19 Pandemic Sba S Office Of Advocacy

Small Business Grants Covid 19 Relief Where To Find Free Money In 2021 Nav

Coronavirus Response Page At Laedc 2021 Los Angeles County Economic Development Corporation

Small Business Grants Covid 19 Relief Where To Find Free Money In 2021 Nav

Covid 19 Assistance Extended For California Small Business Not For Profits

Https Covid Sd Gov Docs Smallbusinessfaqs Pdf

Summary Of Major Tax Provisions In The Senate And House Coronavirus Stimulus Bills Americans For Tax Fairness

Are Covid 19 Local Authority Business Grants Taxable Income Whyatt Accountancy

Coronavirus Response Page At Laedc 2021 Los Angeles County Economic Development Corporation

Https Covid Sd Gov Docs Smallbusinessfaqs Pdf

Union County Freeholders Announce Covid 19 Relief Grant Program For Small Businesses County Of Union

Small Business Resiliency Fund Coronavirus

Coronavirus Response Page At Laedc 2021 Los Angeles County Economic Development Corporation

Small Business Grants Covid 19 Relief Where To Find Free Money In 2021 Nav

Post a Comment for "Is The Covid Small Business Grant Taxable"