Business Use Of Home Depreciation Rate

Use a prorated depreciation percentage if you stopped using your home for business during the year. Business-related toll calls are 100 deductible.

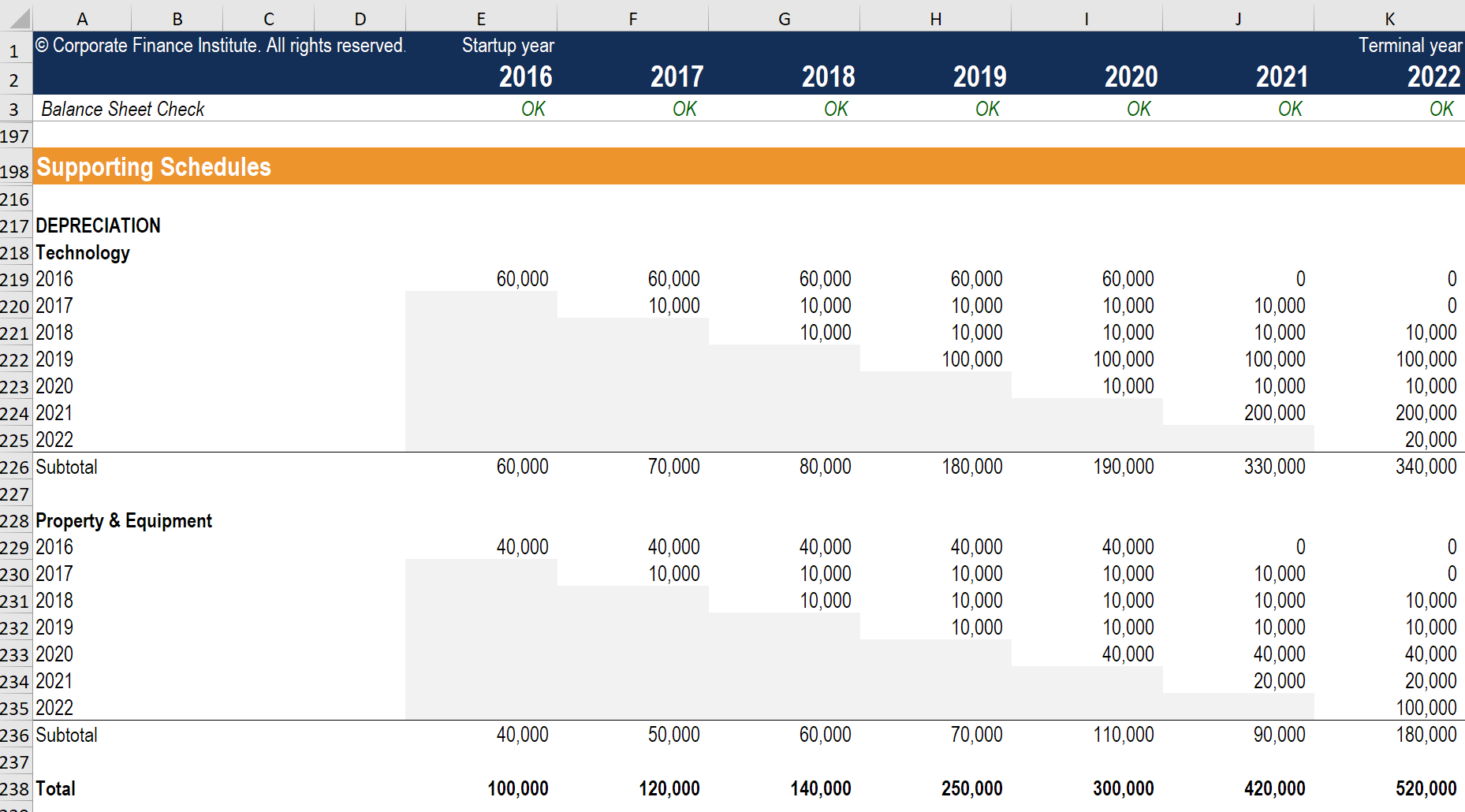

Depreciation Schedule Guide Example Of How To Create A Schedule

For the percentage to use for the first year see Table 2.

Business use of home depreciation rate. Now we can get down to business and tackle the depreciation expense. 10 rows Standard deduction of 5 per square foot of home used for business. To calculate the business percentage divide the area of your home office in square feet by the total area of your home in square feet.

The result is your business percentage. The IRS introduced a second much simpler method of calculating your home office deduction beginning in tax year 2013. Per IRS Publication 587 Business Use of Your Home Including Use by Daycare Providers on page 8.

You calculate the part of your home used for business. Multiply the cost of the improvement by the business-use percentage and depreciate the result over the recovery period that would apply to your home if you began using it for business at the same time as the improvement. When you sell your home the IRS requires that you pay taxes on this amount through something called unrecaptured gain.

For the final year year 40 simply depreciate the remaining undepreciated basis. A different Depreciation percentage than the 2564 used in the example would override this and produce a different result. Expenses for Business Use of Your Home on Part III Line 41.

Telephone costs If you run your business from home you can claim a deduction of 50 of the rental of a telephone landline if this is also your private line. For improvements made this year the recovery period is 39 years. Additionally you can deduct all of the business part of your expenses for maintenance insurance and utilities because the total 800 is less than the 1000 deduction limit.

For example if only 10 of the square footage of your house is reserved exclusively for business use you can only use 10 of your home expenses as a business deduction. Using IRS Form 8829 Part I of Form 8829. Consequently the annual depreciation rate for business use of a home would be 2564 for years 2 through 39 with the first years rate being the prorated amount for the number of full months plus a half for any partial month the home was used for business in the initial year.

Business - Use of Home - Depreciation 39 Years Depreciation on your home is deductible only if you use your home for business. If the taxpayer is depreciating assets in addition to the home itself enter the home on Form 4562 rather than Part III of Form 8829. Revenue Procedure 2013-13 PDF allows qualifying taxpayers to use a prescribed rate of 5 per square foot of the portion of the home used for business up to a maximum of 300 square feet to compute the business use of home deduction.

Self-employed taxpayers filing IRS Schedule C Profit or Loss from Business Sole Proprietorship first figure this deduction on Form 8829 Expenses for Business Use of Your Home. Youll see Depreciation Allowable. The first time you work this out youll need to gather up some information.

You can claim depreciation on capital items such as a computer office furniture and fittings used for business purposes in your home. Figuring the depreciation deduction for the current year. Thats the amount you claimed as depreciation of your home for your small business home office.

Look for Form 8829. Appropriately titled the Simplified Option it works out to 5 per square foot of the business or office space in your home. Your deduction for depreciation for the business use of your home is limited to 200 1000 minus 800 because of the deduction limit.

In this case count the number of months or partial months you used your home for business. Using the Simplified Option qualifying taxpayers use a prescribed rate of 5 per square foot of the portion of the home used for business up to a maximum of 300 square feet to figure the business use of home.

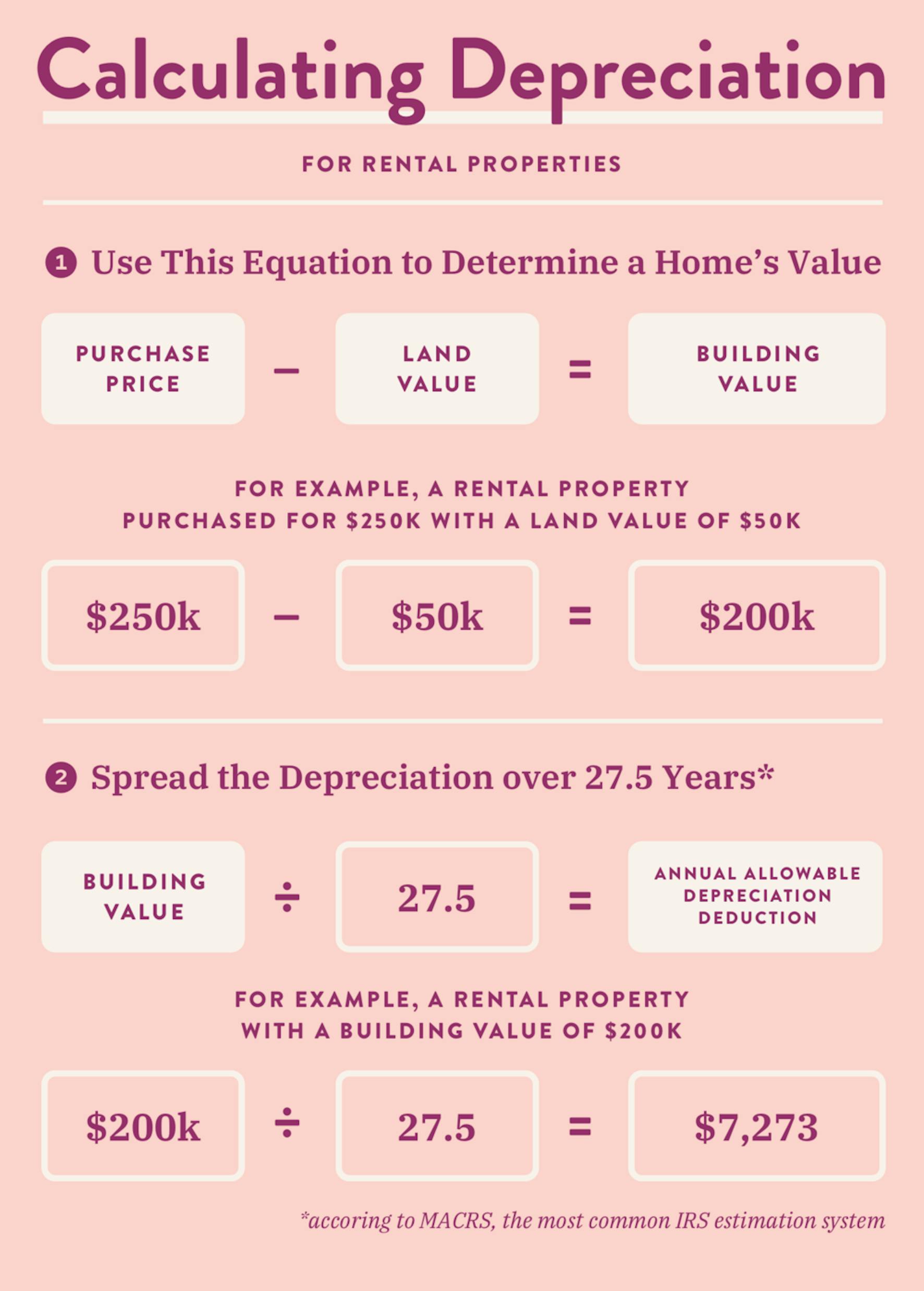

How To Deduct Rental Property Depreciation Wealthfit

Business Valuation Veristrat Infographic Business Valuation Business Infographic

Macrs Depreciation In Excel Formulas To Calculate Depreciation Rate Excel Formula Excel Calculator

Definitions Depreciation In Fixed Assets The Monetary Value Starts To Decreases Over Time Due To Use Wear And T Fixed Asset Marketing Trends Explained

Companies Act 2013 Depreciation Rate For Ay 2020 21 Pdf Acting Pdf Pdf Download

How To Calculate Depreciation Expense For Business

Accounting I Acc 100 Final Milestone Summer 2020 With Answer For 100 Score Income Statement Answers One Year Ago

To Figure Out Your Deduction For Depreciation You Would Use A Form 4562 See Attached To Get An Idea Of What It Loo Form Instruction Internal Revenue Service

Depreciation Of Fixed Assets In Your Accounts Accounting Small Business Office Fixed Asset

The Irs Defines Depreciation As An Income Tax Deduction That Allows A Taxpayer To Recover The Cost Or Othe Real Estate Advice Real Estate Ads Real Estate Book

Home Business Insights Group Ag Economics Lessons Excel Templates Excel

Funny Tax Deductions Funny Infographics Tax Deductions Deduction Business Tax

Depreciation Cost Residual Value Useful Life Depreciation Book Value X Depreciation Rate Business Tax Deductions Accounting Principles Accounting

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Methods Of Depreciation Method Fixed Asset Annuity

Pin By Best Home Decor On Yarn Business Board Granite Flooring Table Guide Flooring

Straight Line Depreciation Schedule Calculator Double Entry Bookkeeping Accounting Cycle Accounting Basics Learn Accounting

Structuring Business Assets Purchases With Taxes In Mind

Depreciation Rate Formula Examples How To Calculate

Post a Comment for "Business Use Of Home Depreciation Rate"