Business Mileage Rate 2019 To 2020 Uk

If this is the case you will be able to claim Mileage Allowance Relief MAR. You should outline your mileage policies prior to agreeing to give the employee either company car fuel allowance or just an allowance to purchase a vehicle.

Things To Know To Get Ready For The 2020 Irs Standard Mileage Rate Irs How To Get Things To Know

14 cents per mile was 14 cents in 2020.

Business mileage rate 2019 to 2020 uk. The mileage for motorcycles bikes and other vehicles varies again refer to the HMRC advisory fuel rates. Annual mileage up to 3500 miles standard rate Annual mileage over 3500 miles standard rate All eligible miles travelled see paragraph 1715 and Table 8 Car all types of fuel 56 pence per mile. So for each mile for which fuel is compensated to that employee according to Advisory Rates your business.

As a result the current AMAP rates are 45p per mile for the first 10000 miles and 25p. The rates apply for any business journeys you make between 6 April 2020 and 5 April 2021. Ditch your mileage tracker forms and let us handle your business miles for taxes.

16 cents per mile was 17 cents in 2020 Charity. In fact the last time AMAP rates changed was in April 2012 when the AMAP rate for the first 10000 car and van miles rose from 40p per mile to 45p per mile. 26 May 2021.

AMAP rates on Govuk. If you are paid a car allowance your employer may reimburse you at a lower mileage rate or not at all. UK drivers spend a lot of time on the road.

Jock can claim MAR on 1200. Luckily if the drive is for business purposes you can claim tax back from HMRC. According to the latest government statistics British vehicles rack up 324 billion miles a year.

Theyre identical to the rates that applied during 2019-20. Jocks business mileage was 6000 miles. What is the car mileage allowance for 2019.

Beginning on January 1 2020 the standard mileage rates for the use of a car also vans pickups or panel trucks will be. Rates per business mile. Increasing to 24100 for 2019-2020 from 6 April and multiplying this sum by the same percentage applicable to emission rates used for the taxable value of cars.

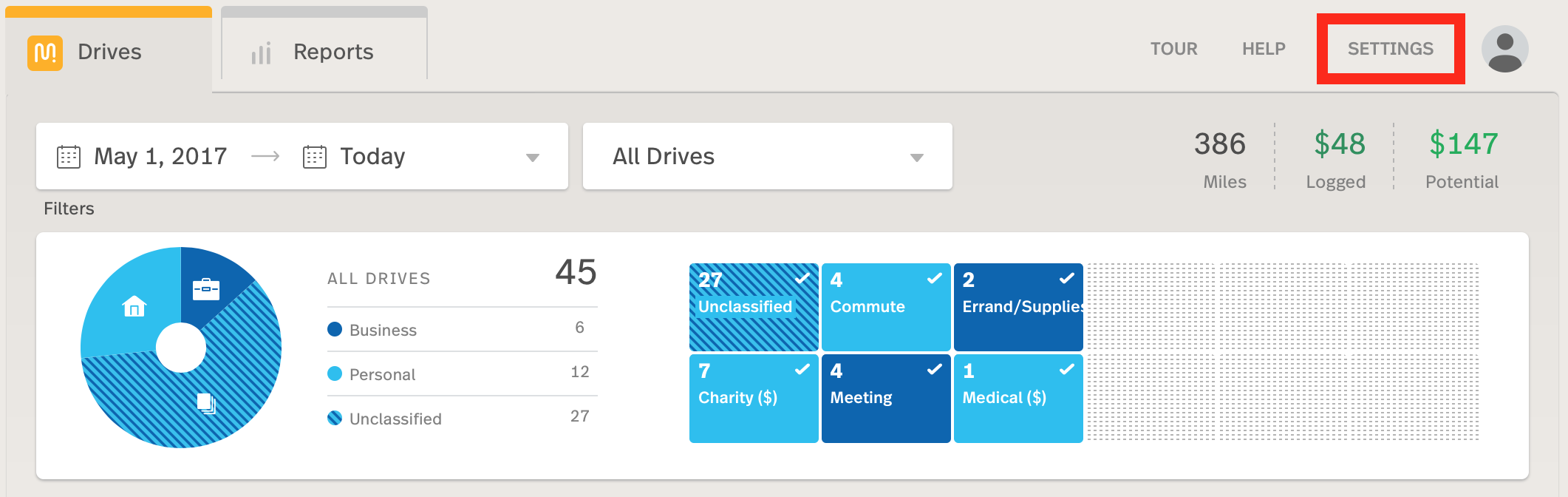

The advisory fuel rates from 1 June 2021 have been added. MileIQ is the leading mileage tracking app for Android iPhone. 575 cents per mile driven for business use down one half of a cent from the rate for 2019 17 cents per mile driven for medical or moving purposes down three cents from the rate for 2019 and.

The advisory fuel rates from 1 March 2020 have been added. Therefore the less a company car is used the more likely it is that tax payments will. 5 pence per mile.

The AMAP rates include the general running costs of your car like maintenance and insurance. 6 April 2017 Rates allowances and duties have been updated for. 20 pence per mile.

The mileage rates for the current 20212022 tax year. 28 pence per mile. 45 pence per mile for cars and goods vehicles on the first 10000 miles travelled 25 pence over 10000 miles 24 pence per mile for motorcycles.

56 cents per mile was 575 cents in 2020 Medical Moving. Free Business Mileage spreadsheet 202122 or 202021. If you have an employee who has a car with a 1500cc petrol engine the fuel element of the 4525 mileage rate is 14 pence per mile September 2019.

Heres an overview of HMRCs current advisory mileage allowance rates. With this in mind heres a definitive look at the UKs business mileage-allowance rates for 2019. The AMAP rate for a car for the first 10000 miles is 45p per mile.

The rates are set under the rules of HMRC simplified expenses a way of HMRC making it easier for people to claim for expenses and keeping it fair for everyone in the UK. 20 pence per mile. 14 pence per mile represents 120 100 plus 20 VAT Therefore 20120 multiplied by the 14p results in 233 pence per mile.

28 pence per mile. Using that rate Jock would have been paid 6000 x 45p 2700 a Jock was actually paid 25p per mile so his total allowance from his employer was 6000 x 25p 1500 b The difference between a and b is 1200. Currently private mileage for cars and vans is 45 per mile up to 10000 miles and 25p per mile over 10000 miles.

Your employee travels 12000 business miles in their car - the approved amount for the year would be 5000 10000 x. Heres more on how to claim MAR. Information has been updated to include tax years 2018 to 2019 and 2019 to 2020 also removed some older details.

Using the advisory fuel rates above you can calculate what percentage of the business mileage rate applies to fuel and calculate the VAT on that element. If Jock is a UK basic rate.

How To Build A 6 Figure Business I Made 106 000 On The Side Make Money Today Make Money Now Passive Income Business

What Is Self Employment Tax And What Are The Rates For 2020 Workest

2020 Standard Mileage Rates Announced Mileage Internal Revenue Service Money Matters

Largest Utility Companies In The U S 2020 Statista

Solved Marking Mileage As Business

What Is The Standard Per Diems Meal Allowance For 2020

Your Guide To California Mileage Reimbursement Laws 2020

How To Record Mileage Help Center

Irs Just Released New 2020 Form W 4 Employee S Withholding Certificate Today Which Is The Form For You To Request How Tax Refund Federal Income Tax Irs Taxes

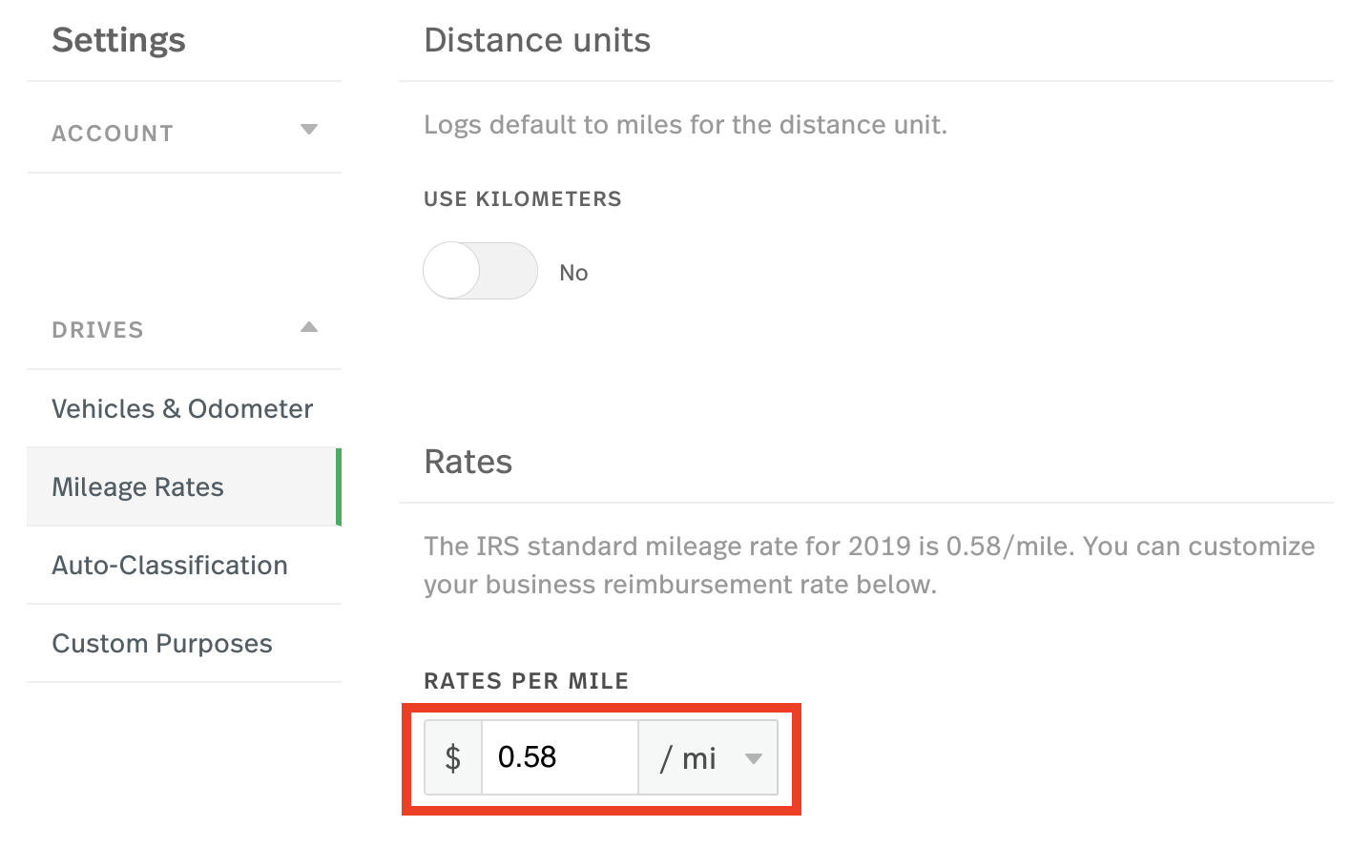

How To Edit The Business Rate And Distance Unit Mileiq

How To Decide An Electric Car Mileage Allowance I T E I

How To Edit The Business Rate And Distance Unit Mileiq

Envision Aesc S Ncm 811 Batteries To Exceed 300 Wh Kg In 2020 Plants Uk Envision Energy Density

Chase Ultimate Rewards Travel Promo Code 2018 In 2020 Travel Promos Chase Ultimate Rewards Holiday Promos

Planner Fun Blog Business Plan Template Mileage Tracker Printable Mileage Tracker

New Taxation Rules For Non Uk Resident Corporate Landlords Dns Accounting Being A Landlord Income Tax Return Corporate

What Do Most Companies Pay For Mileage Reimbursement

What Is The Average Company Car Allowance For Sales Reps

Your Guide To California Mileage Reimbursement Laws 2020

Post a Comment for "Business Mileage Rate 2019 To 2020 Uk"