Retrieve Business Tax Id Number

If you open the return and discover that the number has been replaced with asterisks for. March 31 2020.

How Do I Obtain A Federal Tax Id When Forming An Llc Legalzoom Com

Allow three business days for the processing of a new application before checking the status.

Retrieve business tax id number. Local time Monday through Friday. - Apply online at Apply for an Employer Identification Number EIN Online-Apply by fax. The phone number for the Business Specialty Tax Line is 800-829-4933.

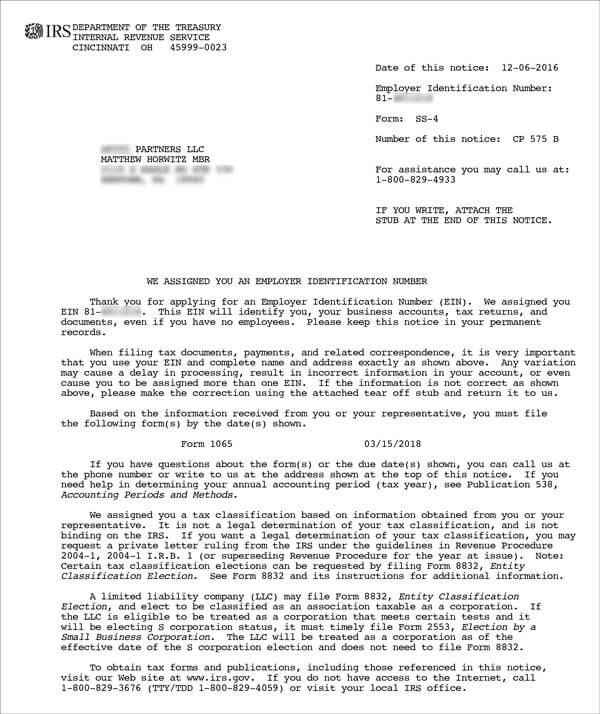

An Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity. You will have to verbally answer the questions from form RC1. Generally businesses need an EIN.

The hours of operation are 700 am. Your nine-digit federal tax ID becomes available immediately upon verification. Registering for Other Taxes and Licenses.

It might be as simple as looking at your W-2. We harvest our data from various publically available data sources such as edgar database SEC form 5500 dataset IRS form 990 datasets tax-exempt organizations etc. Only the authorized person for your business can get this information.

If Organization Name is chosen then all accepted characters are valid. By phone at 1-800-959-5525. Online using the CRA Business Registration Online BRO service.

Sales Taxpayer Search Taxpayers may search by taxpayer number employer identification number EIN legal name business name city and zip code to verify the status active or inactive of a sales and use tax permit. Just about any business big or small has an EIN sometimes referred to as a tax ID number which is recognizable by its format of nine digits with a dash after the first two. If EIN is chosen then only numbers are valid.

It will guide you through questions and ask for your name social security number address and your Doing Business As DBA name. Search by Employer Identification Number EIN or Organization Name. You can fax a completed Form SS-4 application to the appropriate fax number.

See Where to File Your Taxes for Form SS-4-Apply by mail. All business taxpayers must be registered with the Ohio Department of Taxation. This search allows vendors to determine permit status of purchasers before accepting a resale certificate.

Find a previously filed tax return for your existing entity if you have filed a return for which you have your lost or misplaced EIN. Local time Monday through Friday. The department offers two methods to accomplish this - through the Ohio Business Gateway or by paper application.

We have a database of over 73M entities which can be searched to find the ein number of business entities. You can call the IRS directly to retrieve your EIN Monday through Friday between the hours of 7 am. Each option is explained below.

An assistor will ask you for. Call the IRS If all else fails and you really cannot find your EIN on existing documents you can reach out to the IRS by calling the Business Specialty Tax Line at 800-829-4933. You can find the number on the top right corner of your business tax return.

Apply for an EIN with the IRS assistance tool. You can ask the IRS to search for your EIN by calling the Business and Specialty Tax Line at 800-829-4933. To 7 pm Eastern Standard Time.

Depending on the company and your reason for needing to obtain its EIN finding a tax ID number might be an easy task. To obtain a federal employer identification number FEIN from the Internal Revenue Service IRS. Keep in mind that Mondays are the busiest days to call the IRS.

The Business Inquiries allow users to search and retrieve data and images maintained in the Business Database. This department is open from 7 am. You may apply for an EIN in various ways and now you may apply online.

Before you call keep in mind that the IRS needs to prove youre actually authorized to retrieve your business tax ID number. By filling out form RC1 Request for a Business Number BN and mailing or faxing it to the nearest tax service office or tax center. For example youll need to prove you are a corporate officer a sole.

To check the status of a submitted online registration or to retrieve your approved certificate number log in to the Florida Business Tax Application using your user id and password you created for your online registration profile. This is a free service offered by the Internal Revenue Service and you can get your EIN immediately. The Business Database is a collection of files that records business filings submitted to and approved by the Ohio Secretary of State.

Ohio Business Gateway - Use the Ohio Business Gateway to register file. Ask the IRS to search for your EIN by calling the Business Specialty Tax Line at 800-829-4933. Your previously filed return should be notated with your EIN.

Make sure to call between the hours 7 am.

Business Tax Receipt How To Obtain One In 2021 The Blueprint

How To Get My Employers Tax Id Number Quora

Delaware State File Number What It Is How It S Used Harvard Business Services

What You Should Wear To Alabama Secretary Of State Business Search Alabama Secretary Of State Business Search Https Businessneat Secretary Alabama Business

What S An Ein Number How To Get An Ein For Your Llc 3 Ways Llc University

What Is My Tax Id Number Ein Vs Sales Tax Id Paper Spark

Sales Use Tax Credit Inquiry Instructions

Employer S State Id Number Lookup Applications In United States Application Gov

Where Do I Find My Employer Id Number Ein Turbotax Support Video Youtube

What Is A Schedule C Tax Form H R Block

Employers Identification Number For Business Operations Ein Application Online Employer Identification Number Sole Proprietor Sole Proprietorship

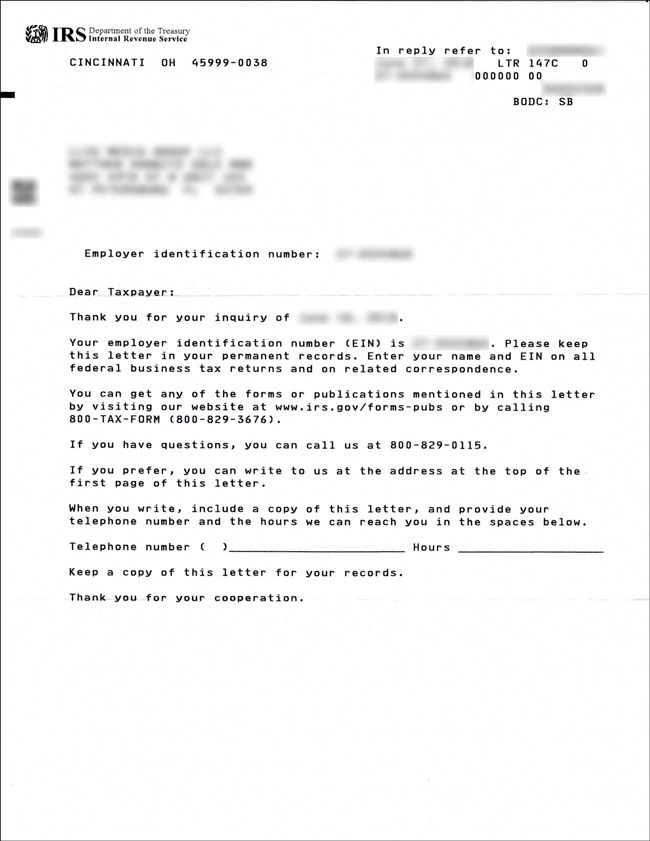

How To Get Copy Of Ein Verification Letter 147c From The Irs

Irs Ein Online Application Know The Benefits And Make Your Application Business Bank Account Filing Taxes Irs

Employer S State Id Number Lookup Applications In United States Application Gov

How To Pay Presumptive Tax In Kenya Winstar Technologies Business Tax Community Business Business Person

Finding Child Care Ein Number 4 Ways To Do It Applications In United States Application Gov

How To Find Your Lost Misplaced Ein Make Your Ein Application Online Finding Yourself Confirmation Letter Online Application

How To Obtain Proof Of Federal Tax Identification Number Fein Kitchensync Support

What Is My Tax Id Number Ein Vs Sales Tax Id Paper Spark

Post a Comment for "Retrieve Business Tax Id Number"