Are Business Tax Filings Public Record

It is also difficult to tell how much a company paid in income taxes from its financial disclosures. Go to the website for the US.

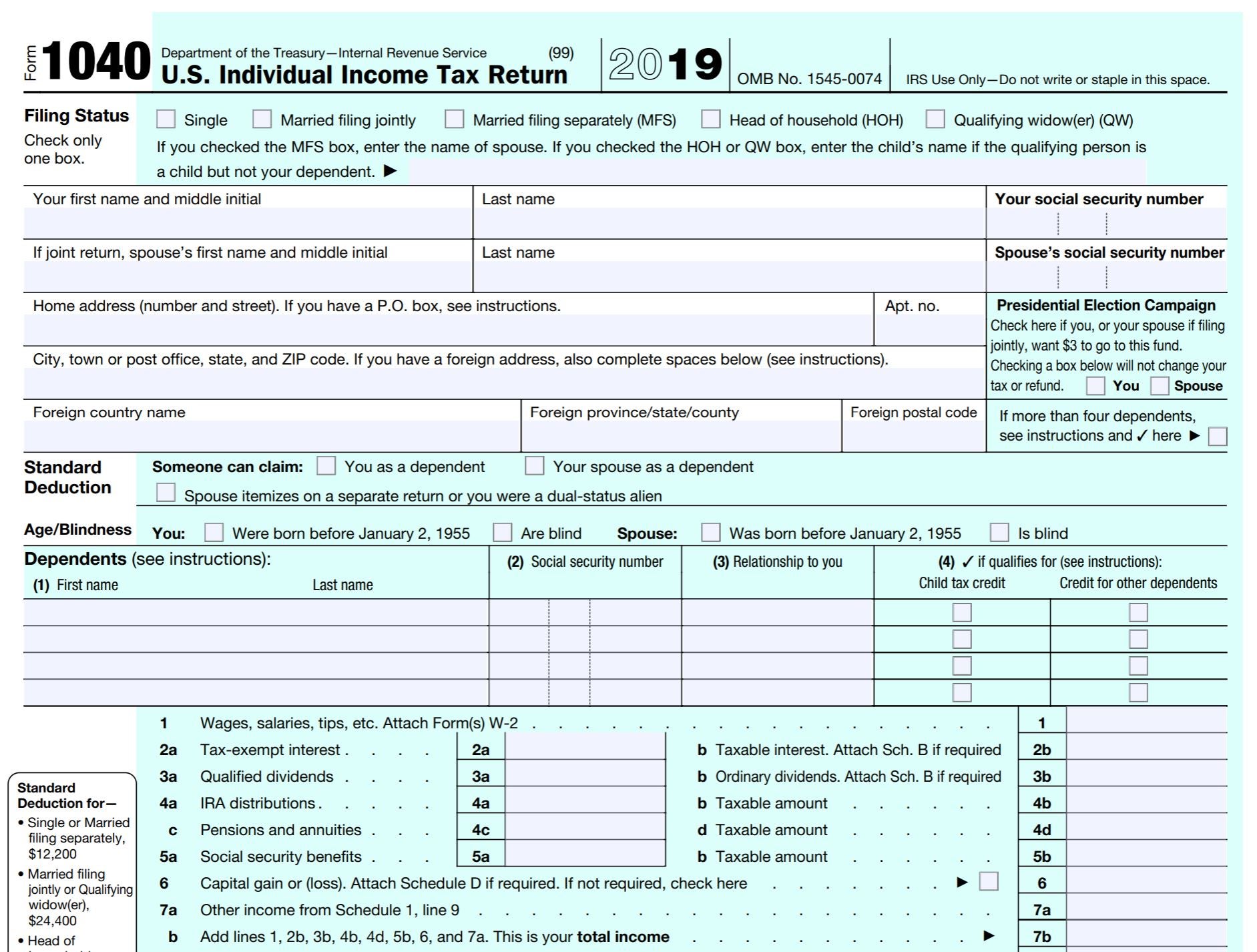

Examples Of Tax Documents Office Of Financial Aid University Of Colorado Boulder

Instead each partner reports their share of the partnerships profits or loss on their individual tax return.

Are business tax filings public record. Any information you give to a company that helps you prepare your taxes can be sold to anyone else. Copies of a companys filings are available for free to the public through this system. Corporate tax returns are not public records.

Whether you need information on a potential business partner a competitor or a supplier it may be worth checking their tax records. Tax Records include property tax assessments property appraisals and income tax records. Vital and Records.

In some cases these documents are publicly available so anyone can access them. Publicly available data on electronically filed Forms 990 is available in a machine-readable format through Amazon Web Services AWS. A legal entity that is separate and distinct from its owners.

Almost every state imposes a business or. With this tool you can make requests and track the progress online. Below are some ways you can get an organizations 990s.

Various laws restrict access to taxpayer and business information and exempt these records from the Public Records Act including. There is no cost to obtain this data through AWS. All states maintain business license records although the responsible office and type of records maintained varies.

Free Property Tax Records Search. The data includes Form 990 Form 990-EZ and Form 990-PF and related schedules with the exception of certain donor information from 2011 to the present. Some states maintain these records at the state level other do so at the county andor city level.

Much of the information collected and held by the Department of Revenue for its customers is confidential and exempt from the Public Records Act. Accounting experts recommend keeping your tax returns for at least seven years. Partnerships however file an annual information return but dont pay income taxes.

The short answer is no. They must also make public their Form 1023 which organizations file when they apply for tax-exempt status. Find residential property tax records including land real property tax assessments appraisals tax payments exemptions improvements.

Certain Tax Records are considered public record which means they are available to the public while some Tax Records are only available with a Freedom of Information Act FOIA request. Corporations that elect to pass corporate income losses deductions and credits through to their shareholders for federal tax purposes. Access EDGAR the SECs document database.

Find Tax Records including. The IRS requires all US. Because of this corporate returns are also not available to certain government agencies.

Corporate tax returns are private simply because they are deemed confidential and are protected under Section 6103 of the Internal Revenue Code as enacted by the Tax Reform Act of 1976. They arent even available to certain government regulators. A relationship existing between two or more persons who join to carry on a trade or business.

All government information is presumed to be available to the public although exceptions may apply to the disclosure of some information. California property tax records. Renaissance Tower - 1201 Elm Street 21st 22nd Floors Dallas TX 75270.

Tax-exempt nonprofits to make public their three most recent Form 990 or 990-PF annual returns commonly called 990s and all related supporting documents. Most businesses must file and pay federal taxes on any income earned or received during the year. Read more about the Public Information Act.

Official Public Records Search. Securities and Exchange Commission to find the public annual financial regulatory filings for any public corporation. Its all made possible by a single Web-based application customized to your companys workflow and needs and delivered at your fingertips.

With iLien youre able to conduct public record searches retrieve and view actual UCC and corporate records create filings and keep track of your entire portfolio. - 415 pm Monday - Friday except for Court Approved Holidays Youll notice a few changes to the Dallas County Clerks Office as a result of the introduction of a new. Records may include corporate filings new business filings issuance of trademarks and renewals of business licenses.

Only a single signature on a permission slip. Experians database covers more than 27 million US. Submit Your Request You can submit an open records request by mail fax in person or using our online FYI Open Records Tool.

Uncover liens judgments bankruptcies and other critical business public records to verify the creditworthiness of customers and partners. Perform a free public tax records search including assessor treasurer tax office and collector records tax lookups tax departments property and real estate taxes.

Self Employed Taxes How To Get Organized Sweet Paper Trail Tax Checklist Tax Preparation Small Business Expenses

Pin On San Diego California Usa

How To Get A Copy Of Your Prior Year Tax Information Catalano Caboor Co Certified Public Accountants Have Our Cpa Filing Taxes Tax Payment Tax Deductions

Irs Form 4606 T Irs Forms Irs Tax Help

Pdf Simple Tax Preparation Checklist Tax Prep Tax Prep Checklist Tax Preparation

Tax Documents Checklist Papers Organizing Home Organizer Paper Organization Free Printables Organization Organization Printables

Rti Right To Information Gives Grants You The Access To Records Of Different Works Documentation And Samples Held By The Public Author Income Tax Income Tax

Public Limited Registration Public Limited Company Private Limited Company Bookkeeping Services

9 Tax Records You Should Keep In Your Business To Avoid Irs Audit 9 Tax Records That Should Always Business Tax Small Business Tax Small Business Bookkeeping

Publication 583 01 2021 Starting A Business And Keeping Records Internal Revenue Service

Get Information Of Specific Tax Liens With Our Trustworthy Public Records Public Records Company Logo Tech Company Logos

5 Easy Tips For Making Tax Season A Breeze Passionate Storyteller Public Speaker Tax Prep Checklist Tax Prep Bookkeeping Business

California Public Records Public Records California Public

Chicago Auditor Need Experienced Professionals For Helming Internal Audit Financial Records And Stateme Accounting Firms Financial Firm Forensic Accounting

Removing Public Records Professional Advice How To Remove Public Records Finance

Printable Tax Prep Checklist Tax Prep Checklist Tax Prep Tax Deductions List

Tax Documents Infographic Tax Appointment Business Tax Tax Organization

4 Form Deductions 4 Benefits Of 4 Form Deductions That May Change Your Perspective 1099 Form Deductions Handy Printabl Tax Prep Checklist Business Tax Tax Prep

Villegas Law Cpa Firm Accounting Services Bookkeeping Business Certified Public Accountant

Post a Comment for "Are Business Tax Filings Public Record"