Wv Business Tax Id Number

Individuals who want to do business in the state of West Virginia may need an EIN Number. A West Virginia tax id number can be one of two state tax ID numbers.

For example if you use your social it will be on every business application you fill out because it.

Wv business tax id number. A WV Sales Tax ID Number 39 Also Called a Sellers Permit Wholesale ID Resale Reseller ID. Apply for an Employer Identification Number EIN online at the Website of the Internal Revenue Service. Striving to act with integrity and fairness in the administration of the tax laws of West Virginia the State Tax Departments primary mission is to diligently collect and accurately assess taxes due to the State of West Virginia in support of State services and programs.

When you enter a business entity name and click the search button you will receive entity names that match your search criteria along with entity type city and status. You need that to buy wholesale sell retail or sell wholesale as well as to lease tangible goods. Then there is a Federal Tax ID Number a Business Tax Registration Number and a Social Security Number for.

Request for Letter of Good Standing. Sales and Use Tax Forms. This is a unique nine-digit number that is similar to a social security number for an individual but instead identifies a business.

WV State Employer Tax ID Number Sales WV State Tax ID Number Sellers Permit Federal Employer Tax ID Number WV Business Tax Registration ID Business License. Generally speaking most businesses need an EIN. Business4WV Start Federal IRS Tax EIN Registration Federal IRS Tax EIN Registration An Employer Identification Number EIN also known as a Federal Employer Identification Number FEIN is a tax number issued by the Internal Revenue Service IRS to identify a business entity.

Enter one or more key words in the business. Before engaging in business activity in West Virginia every individual or business entity is required to register with the West Virginia State Tax Department to obtain a Business Registration Certificate ie the Business License to obtain a business license identification number and maintain a State Tax Department account. THERE ARE 4 WV NUMBERS.

Apply for a West Virginia Tax ID EIN Number Online. You may enter up to 10 four digit codes just separate with a comma like this. To begin your application select the type of organization or entity you are attempting to obtain a Tax ID EIN Number in West Virginia for.

Corporations and LLCs as well as partnerships and independent contractors are required to have it but sole proprietors need it to use instead of a social security number. After completing the application you will receive your Tax ID EIN Number via e-mail. You may apply for an EIN in various ways and now you may apply online.

Notice of Non-Acquiescence - West Virginia State Tax Department Notice of Non-Acquiescence to the West Virginia Office of Tax Appeals Decision in Docket Number 15-310CU. A sellers permit also called a sales tax ID or a state employer Number ID for employee tax withholding. This service will enable you to view registration information on West Virginia corporations and other business types which file with the Secretary of State.

WV Tax ID Number. An EIN Number also called a Federal Tax Identification Number or FEIN is a 9-digit number assigned to a company for the purpose of tax identification. Here are some advantages.

Out-of-state sellers who have no physical presence in West Virginia and no activity in West Virginia other than making other than making sales over the Internet by telephone or mail order are considered. The West Virginia One Stop Business Portal is designed to help you along every step of the way in making your business a success. Striving to act with integrity and fairness in the administration of the tax laws of West Virginia the State Tax Departments primary mission is to diligently collect and accurately assess taxes due to the State of West Virginia in support of State services and programs.

An Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity. If you have trouble finding a business try the following. Business Licensing Business Organization Search.

EIN is short for Employer Identification Number and is sometimes referred to as a Federal Employer Identification Number FEIN Federal Tax Identification Number or Federal Tax ID Number. Generally businesses need an EIN. If you are opening a business or other entity that will have employees will operate as a Corporation or Partnership is.

Before engaging in business activity in West Virginia every individual or business entity must obtain a West Virginia business registration certificate from the State Tax Department. Federal Tax ID Number.

Http Tax Wv Gov Documents Taxforms Busapp Booklet Pdf

How To Get A Certificate Of Exemption In West Virginia Startingyourbusiness Com

Start An Llc In West Virginia 38 Nw Registered Agent

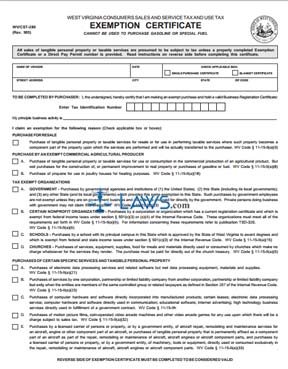

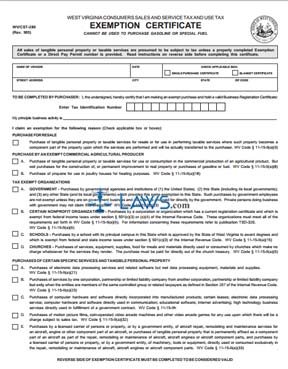

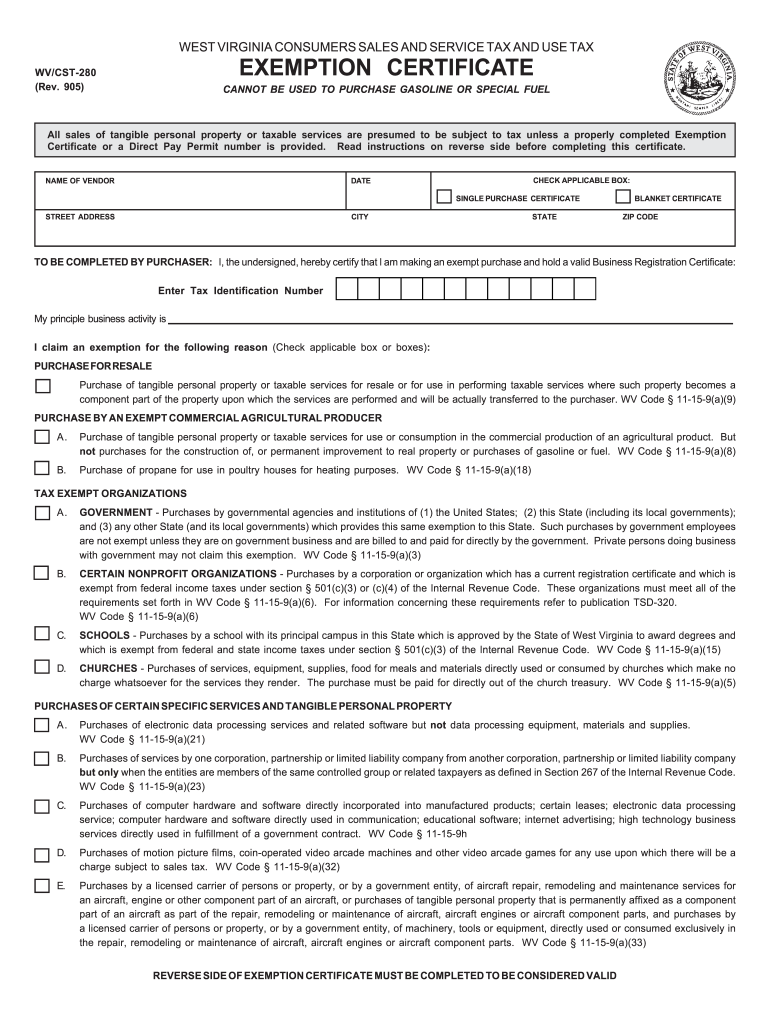

Free Form Cst 280 Consumers Sales And Service Tax And Use Tax Exemption Certificate Free Legal Forms Laws Com

Where S My Refund West Virginia H R Block

How To Register For A Sales Tax Permit In West Virginia Taxjar Blog

Wv W4 Fill Online Printable Fillable Blank Pdffiller

West Virginia Business Search Corporation Llc Partnership Zenbusiness Pbc

Wv Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

West Virginia Tax Return Change Sample 1

Incorporate In West Virginia Do Business The Right Way

Vendor Registration West Virginia Purchasing Division

West Virginia It141 Fill Online Printable Fillable Blank Pdffiller

West Virginia Tax Return Change Sample 1

Post a Comment for "Wv Business Tax Id Number"