Llc Tax Filing Deadline 2021 Texas

Sole proprietorships and single-owner LLCs must apply for an extension by May 17 2021 which extends their tax-filing deadline to October 15 2021. In addition to being the federal 2020 return filing due date for all taxpayers in Texas Oklahoma and Louisiana today also is the deadline for the second estimated tax payment for the 2021 tax year.

Irs And Indiana Dor Extend Tax Filing Deadline To May 17 2021 Whitinger Company

Reporting Due Dates for 2021.

Llc tax filing deadline 2021 texas. A domestic LLC with at least two members is classified as a partnership for federal income tax purposes unless it files Form 8832. AUSTIN In response to the recent winter storm and power outages in the state Texas Comptroller Glenn Hegar announced today that his agency is automatically extending the due date for 2021 franchise tax reports from May 15 to June 15. For applicable taxes quarterly reports are due in April July October and January.

A Limited Liability Company LLC is an entity created by state statute. Following the recent disaster declaration issued by the Federal Emergency Management Agency FEMA the IRS is providing this relief to the entire state of Texas. If the extension request does not meet the payment requirements when the report is filed penalty and interest will apply to any part of the 90 percent of the tax not paid by June 15 and to any part of the 10 percent of the tax not paid by Nov.

Due to the winter storm that left millions without power and water mid-February the IRS has extended the filing deadline to allow those impacted more time to complete their returns. It also applies to the quarterly payroll and excise tax returns normally due on April 30 2021. This extension also applies to 2020 tax payments.

2021 Federal Tax Deadline Extensions The federal tax filing deadline for 2020 taxes has been automatically extended to May 17 2021. You must apply for a tax extension no later than your typical tax deadline. What is the penalty if you miss the deadline.

15 2021 to file their report and pay the remainder of the tax due. Non-EFT taxpayers who request an extension have until Nov. Partnerships and S Corporations must apply by March 15 2021 which extends their tax-filing deadline to September 15 2021.

When a reporting due date happens to fall on Saturday Sunday or a legal holiday the reporting due date becomes the next business day. 19 hours agoThe June 15 2021 deadline applies to the first quarter estimated tax payment due on April 15. Due to severe winter storms the IRS has also extended the tax deadline for residents of Texas Oklahoma and Louisiana to June 15 2021.

Due dates on this chart are adjusted for Saturdays Sundays and legal holidays. The extended deadline is a result of the winter storm. LLC taxes in Texas are like most of the rest of the laws governing business in the state very favorable to companies that do business there.

IR-2021-43 February 22 2021. Douglas Hord from My Tax Guy in Houston LLC explains what you need to know. While most Americans must file and pay their federal income taxes by the IRSs extended May 17 deadline Texas residents have about another month to go before their due date.

After FEMA made a disaster declaration as a result of Februarys winter storms the IRS announced a tax deadline extension for Oklahomans and Texans to. The IRS has announced that it is extending the April 15 2021 tax filing and payment deadlines for victims of February 2021 winter storms in Texas Oklahoma and Louisiana beginning February 11 2021 to June 15 2021. Updated November 2 2020.

2 days agoThe deadline to file taxes in Texas Oklahoma and Arkansas is June 15. TX-2021-02 February 22 2021 Victims of winter storms that began February 11 2021 now have until June 15 2021 to file various individual and business tax returns and make tax payments the IRS announced today. If you havent filed your taxes its time to stop procrastinating.

The deadline to file a federal tax return has been extended to June 15 2021 for all Texas Oklahoma and Louisiana residents and businesses. For example for reports normally due on the 25th of the month a. This extension applies to the entire state of Texas and other states that include declared winter storm disaster areas.

LLCs or limited liability companies are legal entities that are filed at the state level with special protections when it comes to liability. WASHINGTON Victims of this months winter storms in Texas will have until June 15 2021 to file various individual and business tax returns and make tax payments the Internal Revenue Service announced today. This leads to significant differences between LLCs founded in Texas and in any.

Depending on elections made by the LLC and the number of members the IRS will treat an LLC either as a corporation partnership or as part of the owners tax return a disregarded entity. Following an announcement from the Internal Revenue Service IRS on February 22 2021 Texas residents and business owners suffering from the February 2021. The extension aligns the agency with the Internal Revenue Service IRS which earlier this week extended the April 15 tax-filing and payment deadline to June 15.

See more videos about Videos Texas Money United States Personal.

When Are 2020 Tax Returns Due In Each State Fox Business

October 15 Is The Deadline For Filing Your 2019 Tax Return On Extension

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Irs Extends Filing And Payment Deadlines For Tax Year 2020 Tax Pro Center Intuit

Irs And Many States Announce Tax Filing Extension For 2020 Returns

Federal And State Tax Filing Deadlines Extended

Irs Extends Tax Deadlines For Texas Residents And Businesses Mc Gazette

Irs Makes It Official Tax Deadline Delayed To May 17 2021 Cpa Practice Advisor

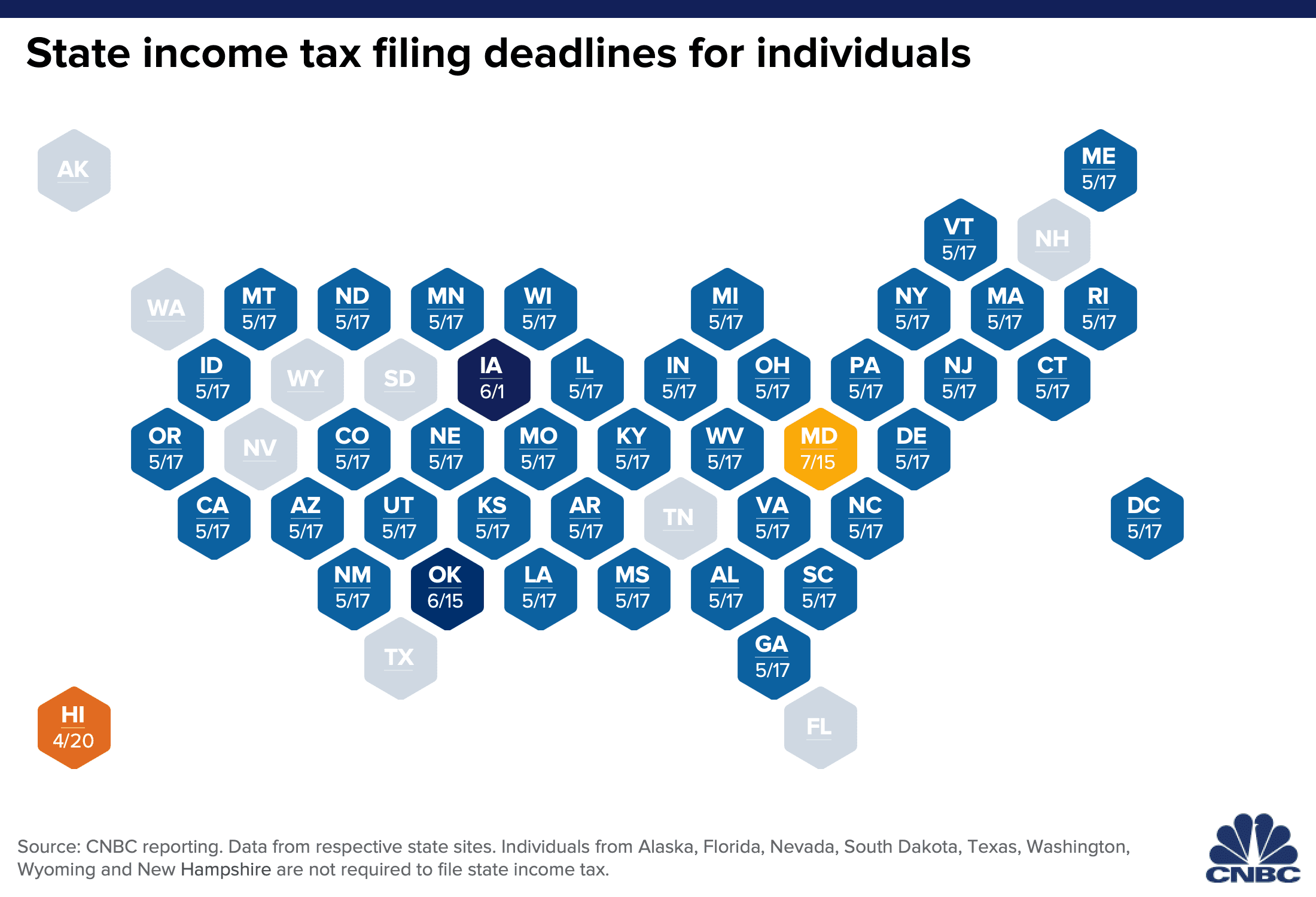

2021 State Tax Filing Deadline Changes

The 2021 Tax Filing Deadline Is Extended For Texas Oklahoma And Louisiana Residents Taxact Blog

Irs And Indiana Dor Extend Tax Filing Deadline To May 17 2021 Whitinger Company

Irs Extended The Federal Tax Deadline When State Tax Returns Are Due

The New U S Tax Deadlines For 2020 Covid 19 Bench Accounting

Your Guide To State Tax Deadlines For Filing Returns Making Estimated Payments During Covid 19

Tax Day Irs Pushes 2020 Tax Filing And Payment Due Date From April 15 2021 To May 17 2021 Abc7 San Francisco

Tax Day 2021 Tax Filing Deadline H R Block

Ohio Income Tax Deadline Moved To May 17

Make Sure You Know Your Irs Tax Deadlines For Filing Your 2020 Business Taxes In 2021

Tax Filing Deadline Is Coming Up What To Do If You Need More Time Mauldin Jenkins

Post a Comment for "Llc Tax Filing Deadline 2021 Texas"