Does My Business Qualify For Ppp

You were in operation as of February 15 2020 You are an independent contractor sole proprietor or other qualifying business classification with self-employment income In 2020 you filed a. If you have previously received a Paycheck Protection Program PPP loan certain businesses are eligible for a Second Draw PPP loan.

If your business has multiple locations you have no more than 500 employees per location.

Does my business qualify for ppp. If a sole proprietor had no payroll and had a negative net income they did not qualify for a PPP loan. To qualify for a Second Draw PPP loan you must meet the following requirements. Small business with 500 or fewer employees may be eligible.

This has now changed with newly expanded eligibility. In addition to small business concerns a business is eligible for a PPP loan if the business has 500 or fewer employees whose principal place of residence is in the United States or the business meets the SBA employee-based size standards for the. Your business was operational before February 15 2020.

Small enterprises or NGOs with 500 or fewer employees are entitled to other SBA 7. Your business is still open and operational. Types of businesses eligible for a Second Draw loan.

Businesses who apply for the PPP loans are required to be in existence since at the very least February 15 2020. Small businesses S corporations C corporations LLCs private nonprofits tribal groups veteran groups and faith-based organizations can all qualify. New PPP Borrowers Who Lie Under the Below-Mentioned Cluster Can Qualify for the Program.

However if you filed a Form 1040 Schedule C on your 2019 tax return you likely qualify to receive a PPP loan. It also must be an eligible type of business and meet stricter size requirements. 15 2020 to qualify.

Self-employed business owners including independent contractors are. Determine if the PPP works for your business and do so by calculating the numbers based on your Schedule C for 2019. Yes Even if You Have Not Formed an LLC You Still Qualify Many freelancers and side hustlers have incorrectly assumed they do not qualify for a PPP loan because they have not incorporated their business as an LLC or S-Corp.

Your business must have been in operation as of February 15 2020 in order to apply for a PPP loan. None of this happens nor does. Applicants must have been in operation on Feb.

You have already received and used or will use your First Draw PPP funding for its authorized uses Your business has fewer than 300 employees You can show at least a 25 reduction in your gross receipts between comparable quarters in 2019 and 2020. To qualify for a PPP loan self-employed individuals must meet the following criteria. First your business must have received a PPP loan and fully spend the funds before you receive the second draw loan you dont need to spend it all before you apply however.

Now your business must show gross income or a net profit to qualify. Depending on when your business was established you may still qualify for a PPP loan. You are eligible to apply for your first PPP loan if you are.

Sole proprietors can now apply for a PPP1 loan using gross revenue from line 7 of their 2019 or 2020 Schedule C Profit or Loss from Business to calculate the average monthly payroll expense used by the SBA to calculate the loan. Prior to the March 3 2021 change if you were self-employed and did not have employees your business must have showed a net profit on either your 2019 or 2020 Schedule C to qualify for PPP. For most businesses PPP loan amounts are calculated based on average payroll costs over the past year.

However due to the nature of your new business you can calculate your loan amount based on your. PPP loans of up to 25000 did not require collateral or personal guarantees from businesses or business owners so if you default on a PPP. A small business with 500 or fewer employees whose principal place of residence is in the United States a sole proprietor an independent contractor or a self-employed individual.

You have no more than 500 employees. Who Qualifies for a PPP Loan. If the following statements apply to your business you are eligible to apply for your first PPP loan in 2021.

Top Ppp Loan Lenders Updated Approved Banks Providers

Paycheck Protection Program How It Works Funding Circle

Everything You Need To Know About Ppp Loans In 2021 Funding Circle

Pin On Tools For Small Businesses

Pin On Interesting Infographics

What Small Business Owners Need To Know About The New Round Of Ppp Loans

Ppp Loan Program Extended Loan Data Released What Small Businesses Need To Know

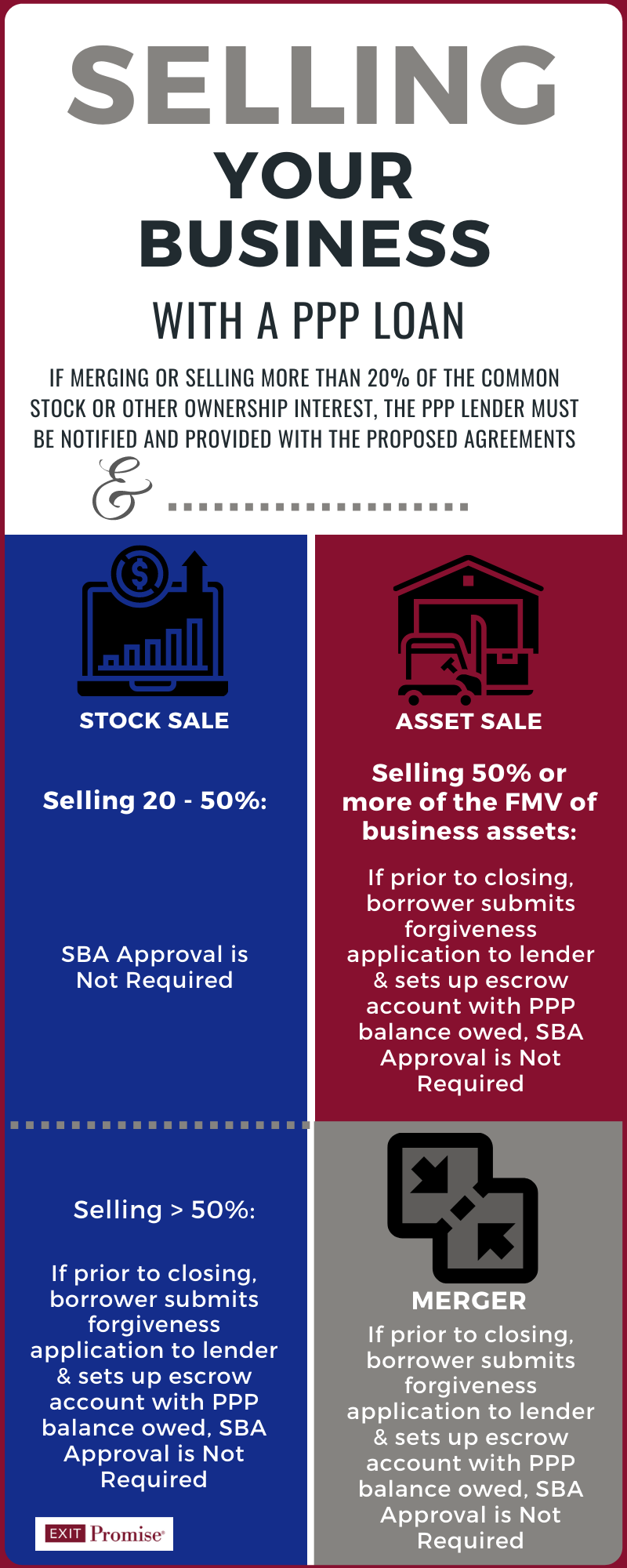

Ppp Loan When Selling A Business Exit Promise

Post a Comment for "Does My Business Qualify For Ppp"