Business Tax Deadline 2021 Maryland

Annual Reports that are postmarked by close of business COB on the Monday following will be considered timely. The federal tax filing deadline postponement to May 17 2021 only applies to individual federal income tax returns and tax payments otherwise due April 15 2021.

State And Local Sales Tax Information For Alabama Including Rules For Online Sales Sales Tax Tax Guide Tax

Responsibility for the assessment of all personal property throughout Maryland rests with the Department of Assessments and Taxation.

Business tax deadline 2021 maryland. The entitys right to conduct business in the State of Maryland. In Maryland there is a tax on business owned personal property which is imposed and collected by the local governments. The deadline to file is April 15th.

Get details on the new tax deadlines and on coronavirus tax relief and Economic Impact Payments. Electronic payments are voluntary for these three business tax types unless the payment is for 10000 or more in. Business Personal Property Taxes.

Please be advised that effective January 1 2021 all legal entities including foreign entities and domestic non-stock corporations will be required to file all past-due Annual Reports to revive reinstate re-register or re-qualify with the Department. In Maryland Comptroller Peter Franchot has pushed back the state income tax filing deadline because state and federal pandemic relief measures require tax form revisions. MARYLAND Because of the coronavirus pandemics impact upon businesses Maryland Comptroller Peter Franchot said his agency has extended filing and payment deadlines for certain Maryland business.

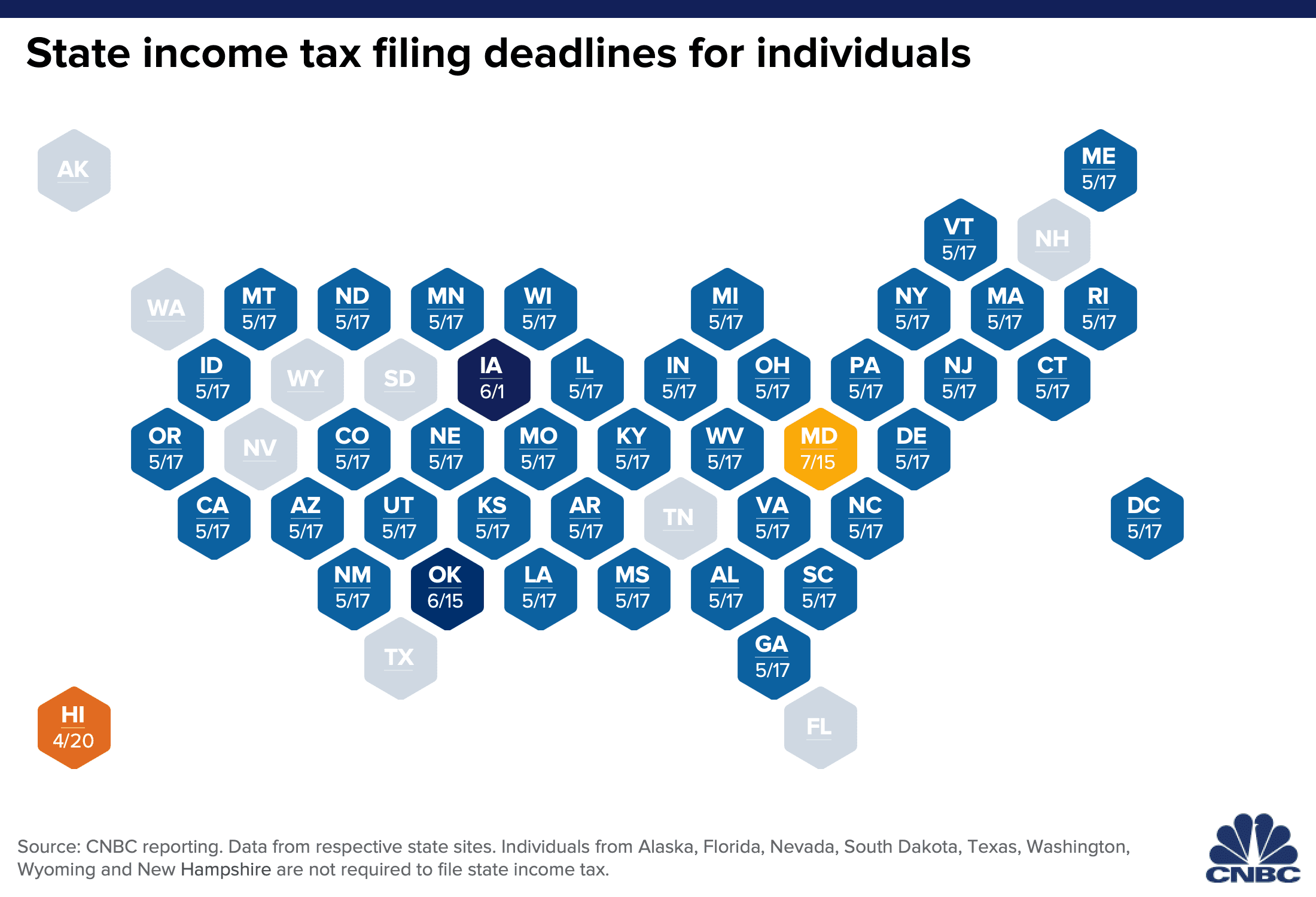

There are several options for businesses to file and pay Maryland income tax withholding motor fuel and corporate income taxes electronically. MARYLAND COMPTROLLER EXTENDS DEADLINES FOR BUSINESS TAXES To provide immediate stimulus to Maryland businesses the comptrollers office announced that it will be extending the deadlines of certain business taxes and quarterly estimated income tax returns and payments until April 15. The deadlines for individuals to file and pay most federal income taxes are extended to May 17 2021.

Maryland tax filers however have until July 15 to submit their individual state tax returns. A properly completed application means that all questions are answered the form is signed copies of the entire federal income tax return schedules and forms necessary Social Security form SSA-1099 Railroad Retirement Verification or. 10 rows On January 6 2021 the office of the Maryland Comptroller announced extended filing and payment.

For more details please read our tax alert. This section supplies the latest information for business taxpayers. The state income tax filing deadline for Marylanders has been extended by three months to July 15 2021.

March 11 2021 - Using statutory authority granted to him Comptroller Peter Franchot today announced that he is extending the state income tax filing deadline by three months until July 15 2021. May 14 2021. Comptroller Peter Franchot is reminding taxpayers that Monday May 17 is the Internal Revenue Service IRS filing deadline for the 2020 tax year for federal individual income tax returns.

Annual Report filing requirements. The state income tax filing deadline has been extended until July 15 2021. Note that relief does not apply to estimated tax payments that are due on April 15 2021.

Should April 15th fall on a weekend the due date is the Monday immediately following. The deadline for filing an application is October 1 2021. The IRS pushed back the tax filing deadline by a month to May 17 instead of April 15 as the agency grapples with staffing issues and outdated systems at.

Personal property generally includes furniture fixtures. No interest or penalties will be assessed if returns are filed and taxes owed are paid by the new deadline. No interest or penalties will be assessed if returns are filed and taxes owed are paid by.

Sales Use Tax Due Dates. For businesses struggling to make business-related tax payments due to COVID-19 closures and restrictions they should email taxpayerreliefmarylandtaxesgov. If you have no taxable sales to report and owe no tax you are still required to file a return.

If a due dates falls on a Saturday or Sunday or holiday the report is due on the next business day. 15 th day of 12 th Month. In an effort to provide immediate stimulus to Maryland businesses the comptrollers office announced today that it will be extending the deadlines of certain business taxes and quarterly.

Tax information tools and resources for businesses and self- employed. WHEN TO FILE. The three-month extension is the most generous tax filing and payment extension of any state in the nation.

2020 Tax Deadline Extension What You Need To Know Taxact

Maryland Business Tax Extension Form 500e

2021 Tax Deadline Extension What Is And Isn T Extended Smartasset

The New U S Tax Deadlines For 2020 Covid 19 Bench Accounting

Comptroller Extends Filing Deadline For Business Tax Returns Payments Conduit Street

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Comptroller Pushes Back Tax Deadlines For Maryland Businesses

Franchot Announces Extension Of Business Tax Filing Deadlines Sbj

E File Irs Form 7004 Business Tax Extension Form 7004 Online

Comptroller Extends Filing Deadline For Business Tax Returns Payments Conduit Street

Maryland Deadline Extension Tax Update Md Mks H

How To Pay Quarterly Taxes If You Re A Business Owner

Maryland Offers Tax Filing And Payment Extensions For Select Businesses Ellin Tucker

Us Tax Deadlines Updated For Expats Businesses Online Taxman

Irs And Many States Announce Tax Filing Extension For 2020 Returns

Irs Extended The Federal Tax Deadline When State Tax Returns Are Due

Ein Tax Id Number How To Apply For A Federal Ein

Post a Comment for "Business Tax Deadline 2021 Maryland"