Business Valuation Formula Ebitda

8 to 10 times EBITDA 10 to 12 times cash flow in medium markets 15 times cash flowlarge markets 15 to 6 times annual sales. Its EBITDA profits times the multiple estimated number of years the profits will continue.

Using The Ev Ebitda Multiple Smartly

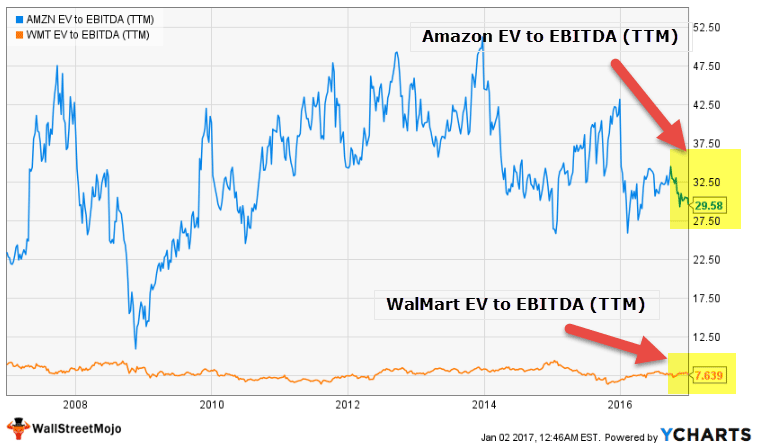

The enterprise multiple is dictated by the business industry the cost of capital and the overall health of business.

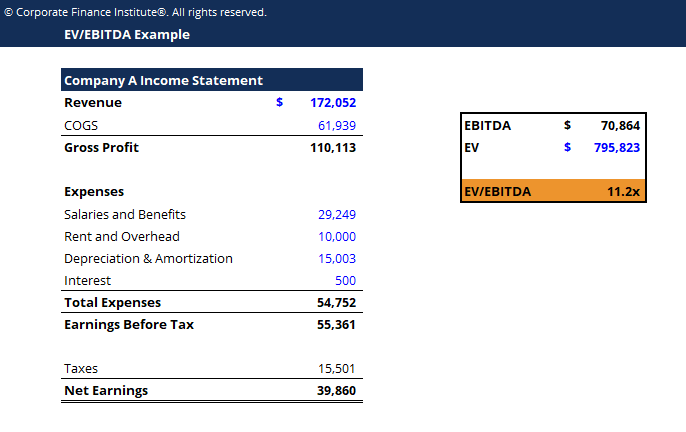

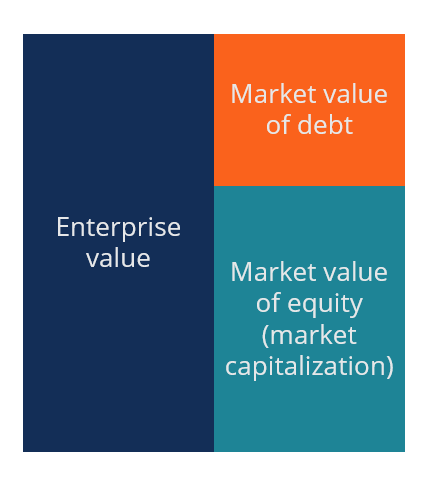

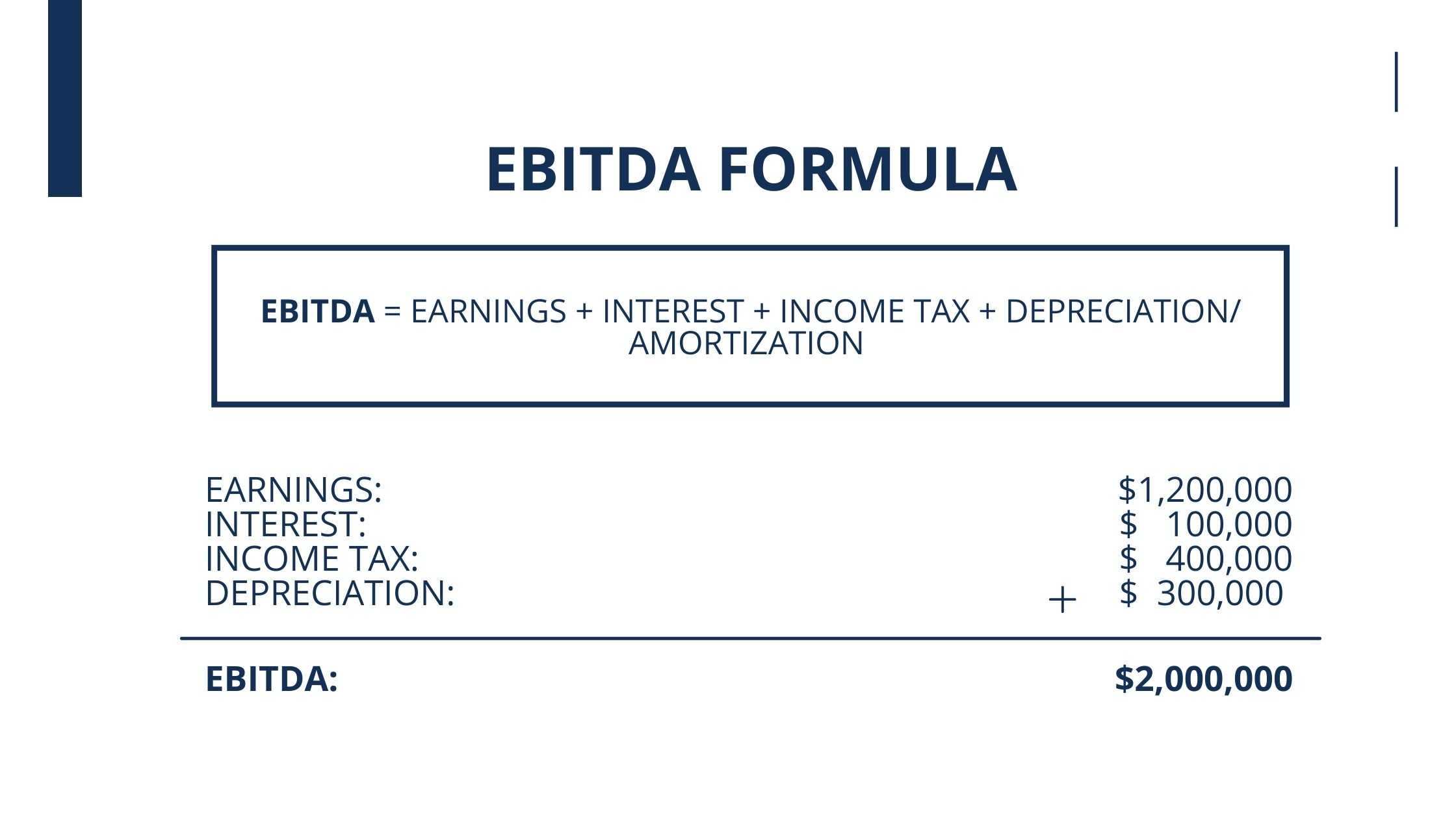

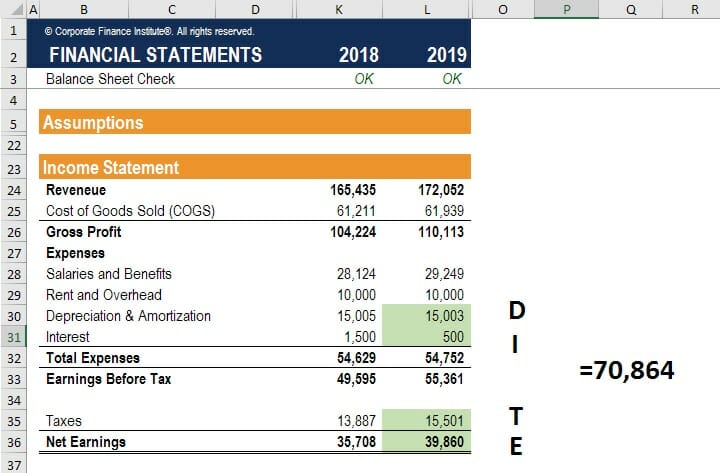

Business valuation formula ebitda. Enterprise Value EBITDA Enterprise Multiple To compute the Enterprise Valuation of a business you take the EBITDA amount and multiply it by an enterprise multiple to get the total enterprise value. EBITDA Operating Profit EBIT Depreciation D Amortization A By eliminating the non-operating effects that are unique to each business EBITDA can help balance the scales by focusing on operating profitability as a singular measure of performance. Also this was a pertinent comment by an industry expert.

For example to calculate the expected value of your business multiply the companys recent EBITDA earnings by the average valuation multiple. The Hadley Capital business valuation calculator applies a multiple of EBITDA to determine the Enterprise Value of your business. Net income defines earnings after the deduction of all the expenses.

One of the veterinary practice valuation formulas uses valuation multiples as shown in the example below. EBITDA margin EBITDA Total Revenue. Determined bythe value of the business as identified in the business appraisal minus the sum of the working capital assets and the fixed assets being purchased.

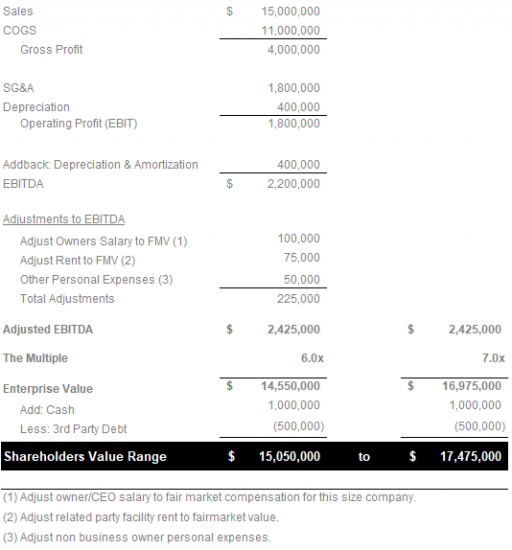

This is the initial range of your companys valuation. SDE Valuation Annual profits owners salary x industry multiple. To calculate EBITDA take the net income from your companys financial statements for the last three years.

Below is the basic formula. When to Consider Using a Business Valuation Expert. Once youve got a range of multiples apply them to your EBITDA figure.

The formula for an EBITDA margin is as follows. James these are the valuation formulas that I discovered. For example if youve determined that comparable companies to yours sold for 4-6 times EBITDA then multiply your EBITDA by 4 and then by 6.

How to Use EBITDA to Value Your Company Its not the only number potential buyers look at but EBITDA will give you a solid idea of how theyll start evaluating your business. For example if your companys adjusted net profit is 100000 per year and you use a multiple like 4 then the value of the business will be calculated as 4 x 100000 400000. Sellers Discretionary Earnings SDE Multiple Formula.

In profit multiplier the value of the business is calculated by multiplying its profit. SDE stands for Sellers Discretionary Earnings and is calculated by adding EBITDA to the owners income and benefits. What is the EBITDA Margin.

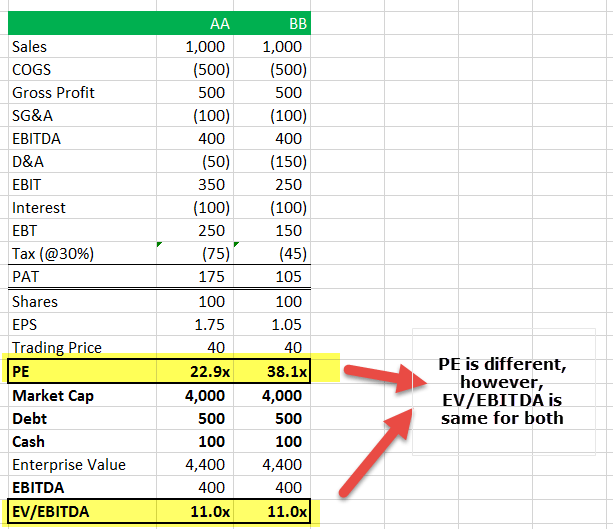

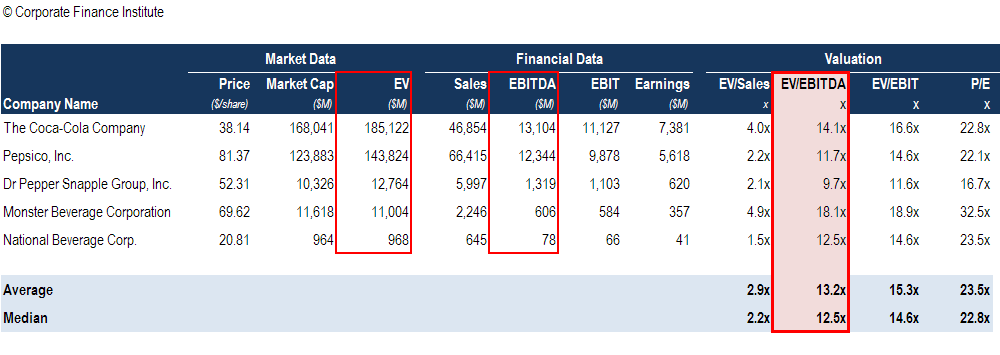

You can estimate the value of a company in the same industry sector and with similar financial and operational attributes using the EBITDA valuation multiples. Meet the team Experienced partners personally invested and involved. Business Valuation Formula So when youre considering what a company is worth this is how it works mathematically.

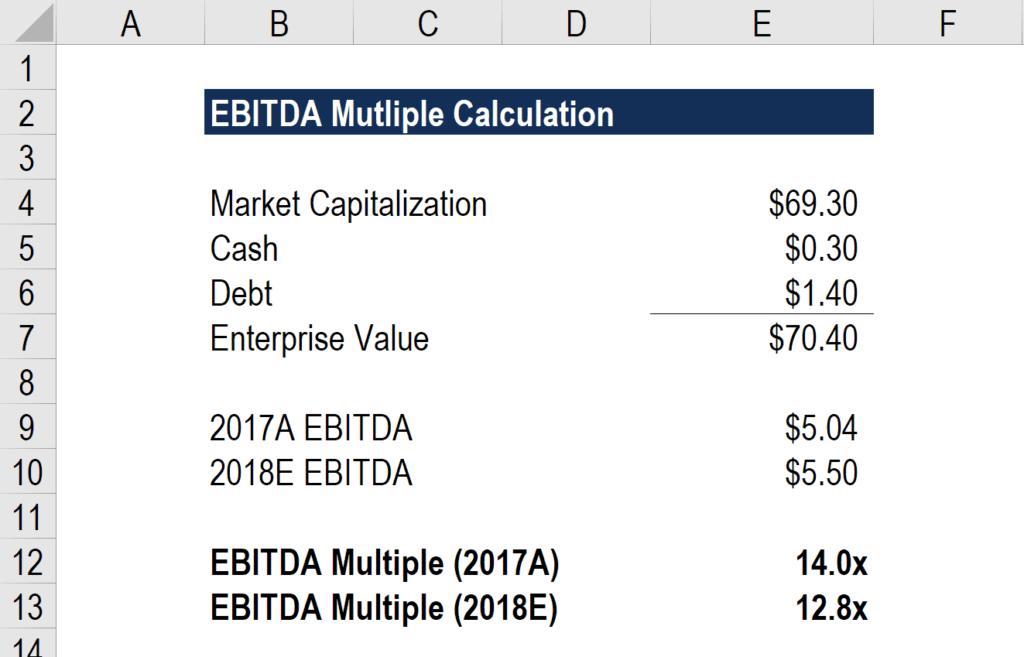

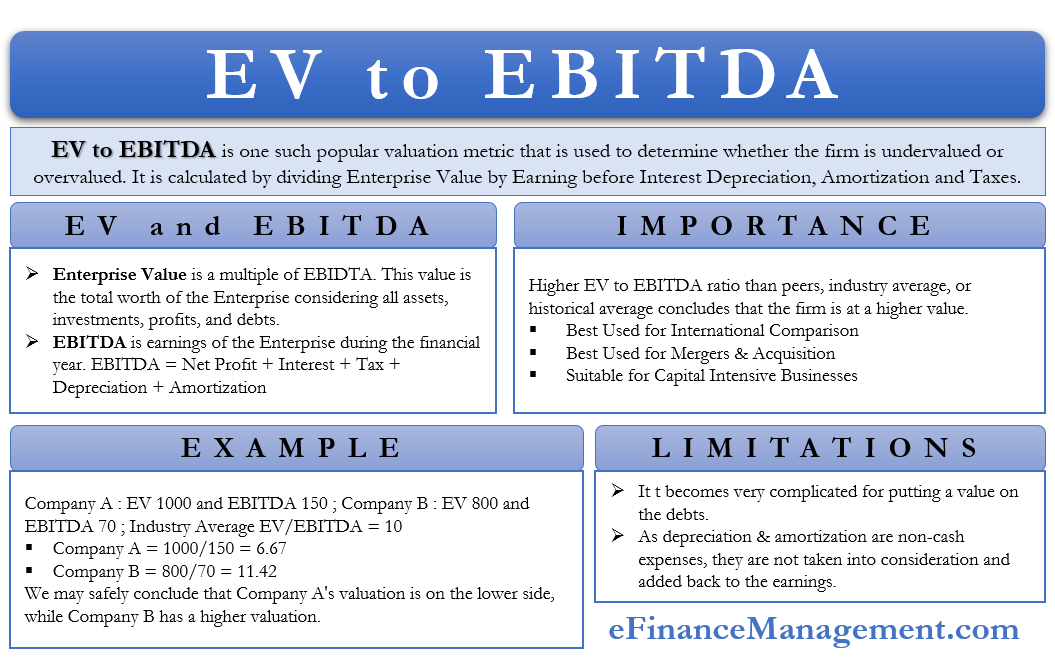

Learn the value of your company today. Annual Sales Multiple Formula. EVEBITDA is a ratio that compares a companys Enterprise Value Enterprise Value EV Enterprise Value or Firm Value is the entire value of a firm equal to its equity value plus net debt plus any minority interest EV to its Earnings Before Interest Taxes Depreciation Amortization EBITDA EBITDA EBITDA or Earnings Before Interest Tax Depreciation Amortization is a companys profits before any of these net deductions are made.

Enterprise Value market capitalization value of debt minority interest preferred shares cash and cash equivalents EBITDA Earnings Before Tax Interest Depreciation Amortization. As the acronym suggests add back interest taxes depreciation and amortization from net income to calculate the companys EBITDA. By determining a percentage of EBITDA against your companys overall revenue this margin gives an indication of how much cash profit a business makes in a single year.

This is the most common metric used by buyers to assess the starting point for a valuation. EBITDA Multiple Enterprise Value EBITDA To Determine the Enterprise Value and EBITDA. Intangible assets business value working capital fixed assets Working Capital Current Assets Current Liabilities.

Subtract total costs from total revenues. Business Valuation Annual sales x industry multiple.

What S The Value Of My Business The Ins And Outs Of Ebitda Multiples Cronkhite Capital

Ebitda Multiple Formula Calculator And Use In Valuation

Ev To Ebitda How To Calculate Ev Ebitda Valuation Multiple

An Alternative Approach Of Testing A Business Valuation

Introduction To Enterprise Value Ev Of The Business Magnimetrics

Ev Ebitda Template Download Free Excel Template

Ebitda Multiple For Business Valuation Magnimetrics

How To Use Ebitda For The Valuation Of Your Small Business

Ev To Ebitda How To Calculate Ev Ebitda Valuation Multiple

Ev Ebitda Guide Examples Of How To Calculate Ev Ebitda

Ebitda Margins What Every Small Company Owner Needs To Know

Ebitda Multiple Formula Calculator And Use In Valuation

Ev Ebitda Guide Examples Of How To Calculate Ev Ebitda

Ev To Ebitda How To Calculate Ev Ebitda Valuation Multiple

How To Estimate The Value Of A Private Company What Is My Business Worth

Ebitda Multiple Formula Calculator And Use In Valuation

How To Calculate Terminal Value In A Dcf Analysis

Ev To Ebitda Definition Formula Interpretation Better Than Pe Example

How To Calculate Terminal Value In A Dcf Analysis

Post a Comment for "Business Valuation Formula Ebitda"