Business Expenses Not Reimbursed By Employer

Under the Fair Labor Standards Act FLSA employers are not required to reimburse employees for business expenses. If an employees actual expenses under an accountable plan are more than the amount reimbursed by the employer the employee can report the difference as Unreimbursed Employee Business Expenses Form 2106 and take an itemized deduction subject to the 2 of adjusted gross income AGI limitation.

According To Most State Laws All Employees Must Be Reimbursed For Reasonably Incurred Business Expenses This In Corporate Outfits Clothes Inspiration Clothes

If you have tax-deductible work expenses which have not been reimbursed by your employer and your allowable expenses are under 2500 you can make a claim for tax relief using Form P87.

Business expenses not reimbursed by employer. For many employees this ability to deduct employment-related expenses that were not reimbursed by your boss was a godsend reducing your tax liability. Individual partners and shareholders may deduct unreimbursed employee expenses that are. Provided they are for work-related expenses and are properly documented these reimbursements are not taxable income to you and should not be included in the W-2 form your employer files with the.

If you are forced to work from home because of COVID-19 your employer should likely be reimbursing you for a reasonable portion of your work-related expenses. Examples of pre-2018 unreimbursed business expenses claimed as itemized deductions include the following. But then Congress suspended the deduction for employee business expenses for tax years 2018 through 2025 as part of the Tax Cuts and Jobs Act of 2017.

Use a company credit card or have your employer billed directly for the expense. Be aware however that some states have their own laws surrounding expense reimbursement. Do not deny reimbursement of otherwise valid business expenses due to non-compliance with internal policies - When confronted with requests for the reimbursement of valid business expenses that are not submitted in accordance with company policy employers should generally reimburse the expense as required by law and treat the policy violation as a disciplinary matter rather than a justification for denying reimbursement.

The TCJA eliminates it for tax years 2018 through 2025. Uniforms and safety clothing not suitable for ordinary wear Professional associations publications and training conferences Required continuing education to maintain job or credentials Chamber. Employees in California may have the right to be reimbursed for a reasonable portion of their out-of-pocket business expenses.

The Tax Cuts and Jobs Act TCJA sounded at least a temporary death knell for a good many itemized deductions when it was signed into law in December 2017. While theyre not required by the IRS accountable plans help you set criteria that comply with IRS regulations on what reimbursements are deductible and what reimbursements count as taxable income. Unreimbursed business expenses are ordinary and necessary expenses incurred by a partner or shareholder which are not reimbursed.

Ordinary and necessary paid. In addition to transportation expenses employees who will be away from home overnight are entitled to reimbursement for meals lodging business calls internet access and tips. Client site visits and hotel stays for overnight business trips count as unreimbursed employee expenses when your employer doesnt offer mileage reimbursement a.

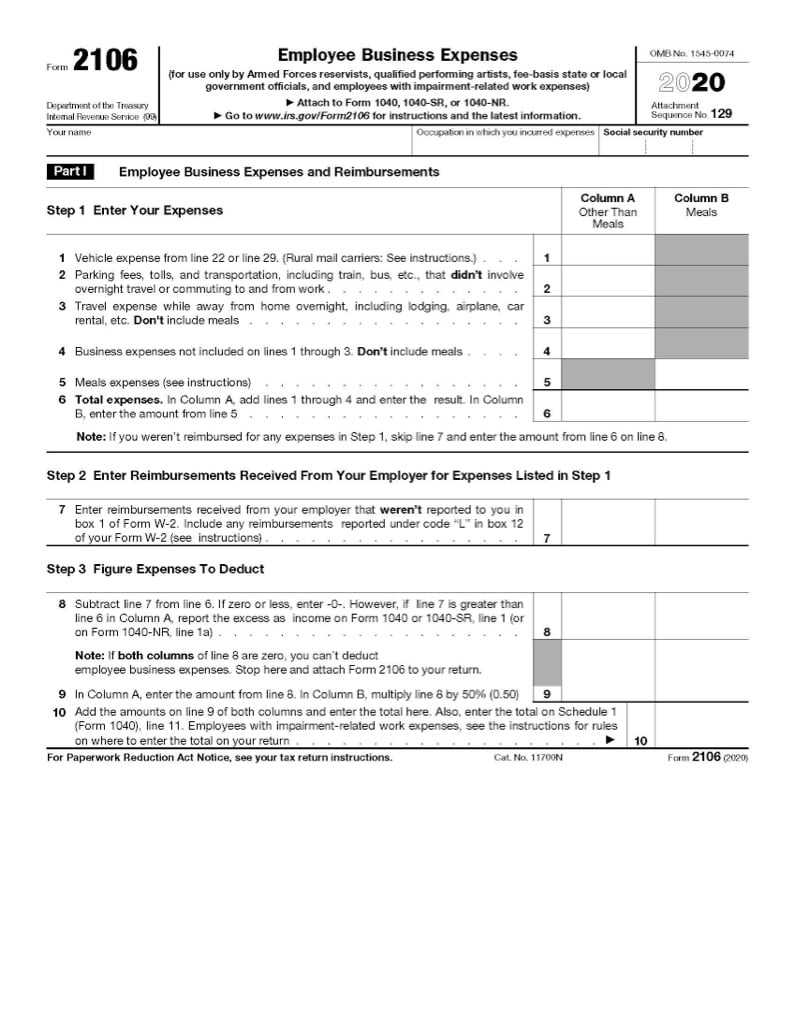

Employees file this form to deduct ordinary and necessary expenses for their job. If an employee does not provide accurate records the employer can refuse to reimburse the expenses. The deduction for unreimbursed employee business expenses was one of those that were affected.

This strategy is more complicated than providing reimbursement because wages and reimbursement are not the same thing. If you must pay for something out of your own pocket have your employer reimburse you. From 6 April 2019 employers will no longer need to operate a system for checking an employees expenditure in order to make payments free of tax in relation to expenses paid or reimbursed using.

While expense reimbursement is only required if it is stipulated in an employment contract or if the business expenses bring the employees wages below minimum wage most businesses reimburse work-related expenses incurred by employees as a job perk. About Form 2106 Employee Business Expenses. If your claim is for 2500 or more you will need to register for self assessment and complete a tax return phone the self assessment helpline on 0300 200.

Most employers reimburse such expenses pursuant to a written policy -. The motel or hotel should itemize the bill so that personal expenses can. However the employee must be allowed to deduct unreimbursed business expenses as itemized deductions.

An ordinary expense is one that is common and accepted in your field of trade business or profession. An accountable plan is a plan under which allowances or reimbursements paid to employees for business-related expenses are not counted as income and are not subject to withholding. A necessary expense is one that is helpful and appropriate for your business.

Employers do not have to reimburse an employees out-of-pocket business-related expenses. In some cases in lieu of expense reimbursement an employer may offer a higher salary than they otherwise would. As sizeable numbers of workers continue to work from home due to the COVID-19 pandemic it may be time for businesses that have not offered to reimburse remote employees work-related expenses to.

Have your employer pay them. However such expenses may not reduce non-exempt employees wages below the minimum wage nor decrease their overtime compensation state law may require employees to be reimbursed for business expenses.

Mileage Log With Reimbursement Form Ms Excel Excel Templates Excel Templates Spreadsheet Template Invoice Template

Expense Claim Form Templates 7 Free Xlsx Docs Samples Templates Business Card Template Design Square Business Cards Design

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Expense Reimbursement Form Template Unique Free 33 Travel Request Form In Templates Business Template Templates Traveling By Yourself

What Is An Expense Report Excel Templates Included Bench Accounting Excel Templates Accounting Business Bank Account

Expense Reimbursement Request Report Template Templates Printable Free Report Template Excel Templates

Employer Pays For All Credit Card Transactions Incurred By Their Employees Employees Are Reimbursed For Credit Card Transactions Credit Card Business Expense

Expense Reimbursement Form Templates 17 Free Xlsx Docs Pdf Samples Templates Excel Templates Form Example

Marketing Project Request Form Template Inspirational Expenses Claim And Reimbursement Form Sample For Excel Excel Templates Invoice Template Templates

Pin On Diy Crafts Design Decorating

Mileage Reimbursement Form Template Mileage Log Printable Mileage Printable Mileage

Expense Reimbursement Policy Best Practices And 3 Templates

Free Expense Reimbursement Form For Excel Templates Printable Free Attendance Sheet Template Template Free

Publication 502 2013 Medical And Dental Expenses Medical Health Savings Account Internal Revenue Service

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Mileage Log Reimbursement Form Templates 10 Free Xlsx Docs Pdf Samples Excel Templates Mileage Templates

Free Printable Travel Expense Report Pdf Template Expense Sheet Expenses Printable Expensive

Download A Free Business Expense Reimbursement Form For Excel Give Your Employees A Simple Way To Submit Reimbursemen Expense Sheet Templates Invoice Template

Form 2106 Claiming Employee Business Expenses

Post a Comment for "Business Expenses Not Reimbursed By Employer"