Business Tax Deadline 2021 In Texas

IRS tax help is. Following the recent disaster declaration issued by the Federal Emergency Management Agency FEMA the IRS is providing this relief to the entire state of Texas.

Victims Of Texas Winter Storms Get Deadline Extensions And Other Tax Relief Cd Bradshaw Associates P C

The postponement does not apply to C-Corps trusts and estates.

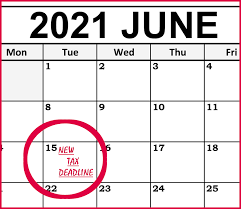

Business tax deadline 2021 in texas. This form must be postmarked on or before May 17 2021 for the 2020 tax year only. This change aligns Texas with the IRS which has also extended the April 15- tax filing deadline to June 15 for ALL Texas businesses and residents who owe franchise tax. When is Tax Deadline 2021.

March 2 2021 Taxpayers in Texas impacted by the recent winter storms will have until June 15 2021 to file various federal individual and business tax returns and make tax payments. WASHINGTON Victims of this months winter storms in Texas will have until June 15 2021 to file various individual and business tax returns and make tax payments the Internal Revenue Service announced today. You must apply for a tax extension no later than your typical tax deadline.

The extension applies to residents in all 254 counties since all were included in a federal disaster declaration. Following an announcement from the Internal Revenue Service IRS on February 22 2021 Texas residents and business owners suffering from the February 2021 winter storm will now have until June 15 2021 to file certain tax returns and make tax payments including 2021 estimated tax payments normally due prior to June 15 2021. See Comptroller Hegars press release.

Sole proprietorships and single-owner LLCs must apply for an extension by May 17 2021 which extends their tax-filing deadline to October 15 2021. Texans who receive a late-filing penalty notice are encouraged to call the IRS to have it abated. For both paper and electronic submissions Form 4868 filing and accompanying payments must be submitted by the 5172021 deadline Hope this helps clear it up.

The deadline to file a federal tax return has been extended to June 15 2021 for all Texas Oklahoma and Louisiana residents and businesses. The June 15 2021 deadline applies to the first quarter estimated tax payment due on April 15. The Texas Comptroller did match the IRSs extension in 2020 for federal tax returns due to the COVID-19 pandemic so guidance is expected to be forthcoming.

Due to statewide inclement weather in February 2021 the Texas Comptroller of Public Accounts is automatically extending the due date for 2021 Texas franchise tax reports to June 15 2021 consistent with the Internal Revenue Service IRS. Due to the winter storm that left millions without power and water mid-February the IRS has extended the filing deadline. Partnerships and S Corporations must apply by March 15 2021 which extends their tax-filing deadline to September 15 2021.

The due date extension applies to all taxpayers. Product alert and News Update post to come. No additional forms are needed to file.

AUSTIN In response to the recent winter storm and power outages in the state Texas Comptroller Glenn Hegar announced today that his agency is automatically extending the due date for 2021 franchise tax reports from May 15 to June 15. IR-2021-43 February 22 2021. Individuals outside the United States file Form 1040 for 2021.

The relief postpones various federal tax filing and payment deadlines that occurred starting on February 11. The normal filing deadline is April 15. The IRS announced in February that victims of the Texas winter storm would have until June 15 to file their 2020 taxes.

The extension applies to a variety of filing deadlines. As a result of the winter storm Texans have until June 15 2021 to file various individual and business tax returns and make tax payments according to the Internal Revenue Service. Texas Comptroller Glenn Hegar announced his agency is extending the 2021 franchise tax reports due date from May 15 to June 15.

What You Need to Know About Texas June 15 Income Tax Deadline Remember Texans have a two-month grace period to file taxes with the deadline pushed until June 15 Published May 17 2021 Updated. Text WASHINGTONThe Internal Revenue Service extended the April 15 tax-filing and payment deadline to June 15 for all residents and businesses in. The extension aligns the agency with the Internal Revenue Service IRS which earlier this week extended the April 15 tax-filing and payment deadline.

It also applies to the quarterly payroll and excise tax returns normally due on April 30 2021.

Irs Makes It Official Tax Deadline Delayed To May 17 2021 Cpa Practice Advisor

2021 Tax Deadline Extension What Is And Isn T Extended Smartasset

2020 Tax Deadline Extension What You Need To Know Taxact

Texas Sales Tax Filing Reporting Schedule Of 2020

Important Sales Tax Dates For April 2019 Accuratetax Com Sales Tax Tax Dating

Irs And Many States Announce Tax Filing Extension For 2020 Returns

The New U S Tax Deadlines For 2020 Covid 19 Bench Accounting

The 2021 Tax Filing Deadline Is Extended For Texas Oklahoma And Louisiana Residents Taxact Blog

Internal Revenue Service Extends Tax Filing Deadline To June 15 2021 Lone Star Legal Aid

2020 Tax Deadline Extension What You Need To Know Taxact

All Is Well Financial Services Texas Income Tax Income Tax Preparation Homeowner Taxes

Victims Of Texas Winter Storms Get Tax Deadline Extensions And Other Tax Relief Front Porch News Texas

Texas Franchise Tax Report Report Year And Accounting Period Explained C Brian Streig Cpa

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

2020 Tax Deadline Extension What You Need To Know Taxact

Agriculture Taxes In Texas Texas A M Agrilife Extension Service

Irs Extends Tax Deadlines For Texas Residents And Businesses Mc Gazette

Pin By D D Financial Services On Dndfinancialservices Org Business Tax Payroll Taxes Financial News

Post a Comment for "Business Tax Deadline 2021 In Texas"