What Are The Quarterly Sales Tax Dates For 2020

Find your filing frequency below for your due dates. Filing Dates for Sales Use Tax Returns.

In All The Chaos Of All Of This Gestures At World I Completely Forgot To Do My Quarterly Sales Taxes I Know A Few Other Thin Tax Time Sales Tax Sale

2nd 2020 quarterly payment due.

What are the quarterly sales tax dates for 2020. Sales Tax Quarterly Calendar. 2020 Sales Use and Withholding Payment Voucher. Whenever a sales and use tax rate changes the corresponding jurisdictional reporting code is replaced with a new code.

Monthly sales tax due on April 30 2020 Quarterly sales tax due on April 30 2020. 49 rows Quarterly filer forms Form ST-100 series Form number. 4th 2020 quarterly payment due.

QET for the months of June July and August 2020 are due on this date. If you remit more than 120 but less than 6000 tax per year 30 - 1500 per quarter you will file a quarterly return which is due on the last day of the month that follows the quarter. October 1 - December 31.

December 2020 monthly and quarterly January 20 2021. 2020 Sales Use and Withholding 4 and 6 MonthlyQuarterly and Amended MonthlyQuarterly Worksheet. Howev-er part of the decrease was due to deferred payments related to the.

Be sure to mark these 2020 days on your calendar. On this page we have compiled a calendar of all sales tax due dates for Connecticut broken down by filing frequency. 2020 Sales Use and Withholding MonthlyQuarterly and Amended MonthlyQuarterly Worksheet.

Authorized Representative DeclarationPower of Attorney. Original Due Date Extension Due Date. 1st 2020 quarterly payment due adjusted due to Coronavirus June 15 2020.

Georgia A Monthly sales tax due on April 20 2020. Sales tax returns may be filed quarterly. Annual returns are due January 20.

First Quarter 2020 Return. September 15 2020. 3rd 2020 quarterly payment Due.

Annual calendar year 2020 February 5 2021. March 2021 monthly and quarterly April 20 2021. Here are the due dates for income earned in.

QET for the months of September October November and December 2020 are due on this date. 4 rows Depending on the volume of sales taxes you collect and the status of your sales tax account. Sales tax returns may be filed annually.

January 15 2021 was the deadline for quarterly payments on income earned from September 1 to December 31 2020. Depending on the volume of sales taxes you collect and the status of your sales tax account with Connecticut you may be required to file sales tax returns on a monthly semi-monthly quarterly semi-annual or annual basis. 15 or less per month.

District of Columbia Monthly sales tax due on April 20 2020 Quarterly sales tax due on April 20 2020. Under 300 per month. Quarterly payment sales tax due on May 26 2020 Due to COVID-19 California sales taxpayers affected by COVID-19 can request to file and pay any sales tax due between March 15 2020 and June 15 2020 by June 15 2020.

June Accelerated Filer accelerated payment for 2021 June 28 2021. Filing frequency is determined by the amount of sales tax collected monthly. The CDTFA assigns a filing frequency quarterly prepay quarterly monthly fiscal yearly yearly based on your reported sales tax or your anticipated taxable sales at the time of registration.

Florida A Monthly sales tax due on April 17 2020 Quarterly sales tax due on April 17 2020. Quarterly forms ST-100 series Annual forms ST-101 series Part-Quarterly Monthly forms ST-809 series Quarterly forms ST-810 series Please remember. If your sales tax liability is less than 1000 for the prior 12-month period beginning July 1 and ending June 30 the Department will notify you in writing that you are being changed to annual filing status.

For sales tax year - March 1 2020 through February 28 2021. Find out more about Californias response to COVID-19 here. It is still unclear whether or not the other dates will be adjusted.

June 2021 monthly and quarterly. Sales and Use Tax.

Where S My Refund It S Quick Easy And Secure Tax Refund Refund Quick

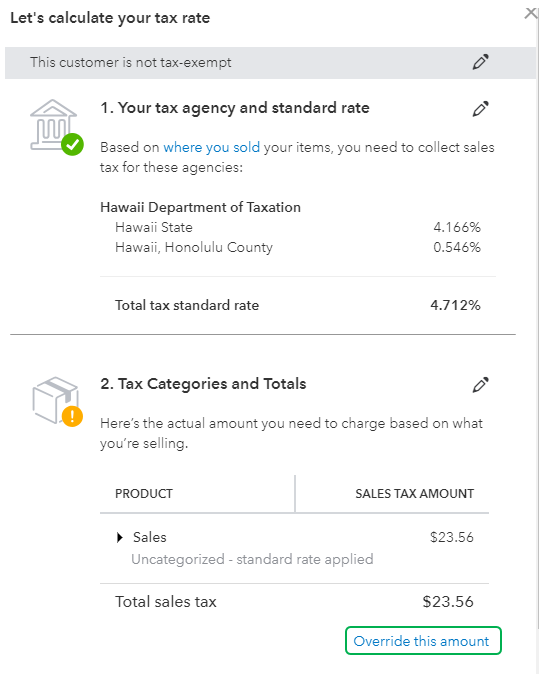

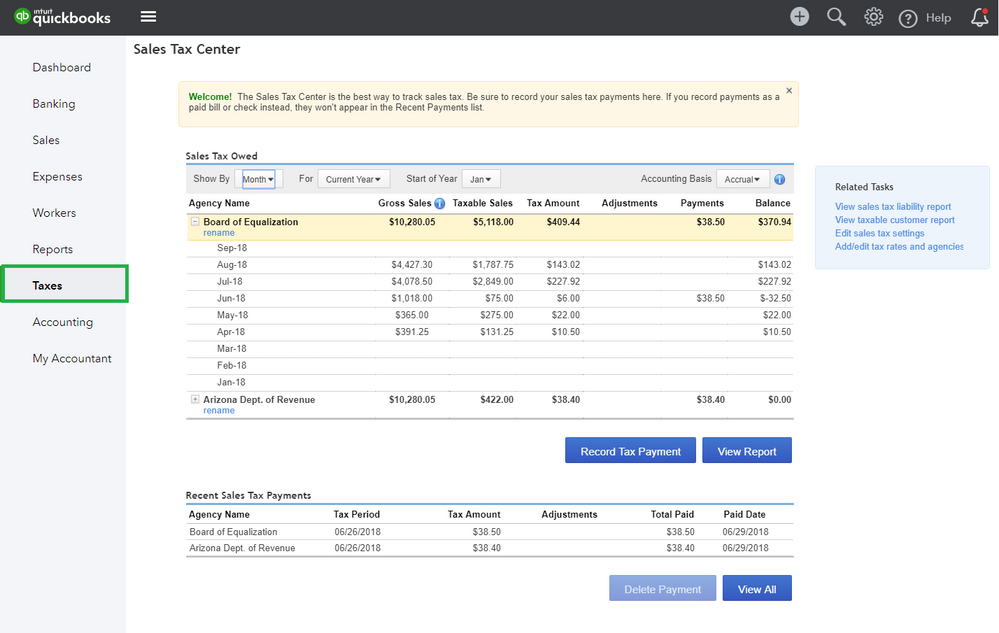

Setting Up For Success With Quickbooks Online Sales Tax In Quickbooks Online

This Quarterly Tax Reference Guide Is For Any Business That Has Employee S And Contra Bookkeeping Business Small Business Accounting Small Business Bookkeeping

When To Worry About Sales Tax Sales Tax Tax Simplify

How To Figure Out File Sales Tax For Your Small Business Small Business Tax Small Business Accounting Software Small Business Accounting

Madison County Sales Tax Department Madison County Al

Self Employed Calculate Your Quarterly Estimated Income Tax Xendoo

Extention Of Income Tax Return Due Date Recommendation For Ay 2020 21 Income Tax Return Income Tax Tax Payment

Https Floridarevenue Com Forms Library Current Dr15n Pdf

Solved Should I Enter My Sales Tax As An Expense Every Time I Pay It Or Is That Automatically Figured Into My Profit And Loss Statement From The Sales Tax Program

Https Www Revenue Pa Gov Formsandpublications Otherforms Documents Dpo 05 Pdf

Setting Up For Success With Quickbooks Online Sales Tax In Quickbooks Online

Wayfair And Your State Sales Tax Obligations In 2021 Sales Tax Business Structure Tax

In Which States Are Groceries Tax Exempt Sales Tax Grocery Items Things To Sell

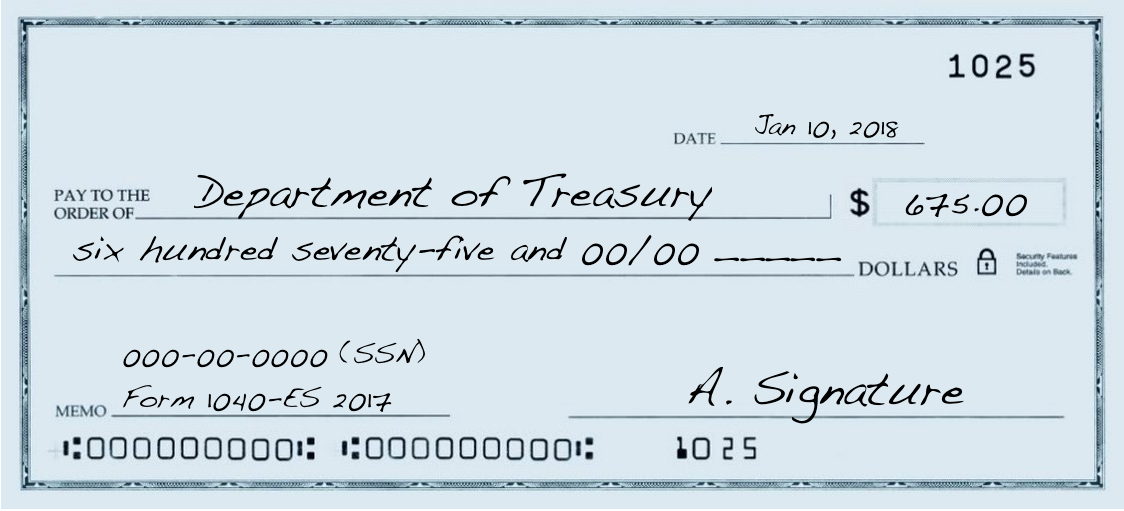

Estimated Quarterly Tax Payments Seattle Business Apothecary Resource Center For Self Employed Women

Estimated Quarterly Tax Payments Seattle Business Apothecary Resource Center For Self Employed Women

What S The Difference Between Quarterly Taxes Vs Annual Taxes Quarterly Taxes Tax Tax Payment

Federal Income Tax Deadlines In 2021 Tax Deadline Income Tax Deadline Filing Taxes

Post a Comment for "What Are The Quarterly Sales Tax Dates For 2020"